The underperformance of value stocks over the past 10 years has received much attention from the financial media and led at least some investors to conclude that value investing – synonymous with Warren-Buffet-style investing – is dead. While headlines like this grab attention, they generally lack knowledge of market history and are devoid of rational thinking.

Irving Fisher was one of America’s greatest mathematic economists. His 1930 The Theory of Interest provided methods used to value assets, which are still the foundation of more sophisticated models of today.

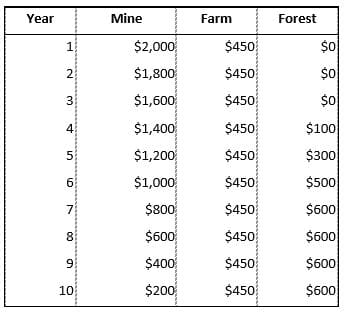

In his book, Fisher described the purchase of a mine, farm, or forest. A mine produces for a relatively brief period, with the highest returns in the first years. A farm, on the other hand, produces a relatively stable output indefinitely into the future. Finally, a new forest provides no output in its initial years and gradually increases over time. You can think of value stocks more like the mine and growth stocks more like the forest.

The forest may in fact have negative earnings for several years. Would you buy a company that has negative earnings?

The logical answer would largely depend on how fast the company can grow and reach profitability. If lacking profits to share in, you’re simply hoping you can gain from someone buying you out at a higher price.

When you look at the history of growth stocks in the U.S. market you find that their superior growth rate does continue but fades quickly over a few years. Then these growth darlings just become an Average Joe. Betting on growth at a faster rate than the market in general for periods extending far into the future has historically been a fool’s bet.

Stocks with negative earnings and cash flows generally produce negative returns for investors. For example, data from AQR Capital Management from 1995-2018 show that on average these companies lost 3 to 5 percent per year. There were just five years when they produced positive returns and only two of these – 1999 and 2018 – had sizable outperformance. Both years happened to occur when technology stocks have dominated, and this trend has continued into 2019.

Recently the market seems to be filled with fools – albeit happy ones with recent gains. But as history shows, it generally doesn’t pay to be a fool, making an implicit bet that a greater fool will buy you out at a higher price.

Non-Fool Investing

Investors have choices. You could join (or remain) in the fool parade and potentially walk off the investing cliff. Or you could be an Average Joe and own a traditional representation of the market – growth and value stocks, large and small stocks, and everything in between along with some dosing of bonds.

But there is a smarter choice – one backed by investing science and empirical evidence. You can diversify across many unique sources of risk and return, of which value stocks are just one, and favor these more than the simple market weighting in the Average Joe portfolio.

The first path is comfortable in the sense that you follow the fools in what has worked and at least you fall off the cliff with company. The second path is more comfortable and certainly more logical. The third path, despite being supported by science, may be the toughest to emotionally conquer.

Why? Unlike the prior two options, you will be different. Your science-based portfolio may cause you to underperform popular benchmarks at times like now when value stocks are underperforming growth stocks.

The smarter path is more likely to lead to successfully achieving goals. And while this path puts probability more in your favor, it still means living through uncomfortable periods. Given that you must accept you will have to live through uncomfortable times, regardless of your investing path, it seems logical that you should choose the path that puts the odds most in your favor.

Value investing is not dead. Only time will tell when the fool parade stops and people like Warren Buffet suddenly look smart once again.