Fixed income can play an important role in an investment portfolio. But its role may vary according to an investor’s financial needs and concerns. For example, many investors look to fixed income for safety, income, and more stability in their portfolios. They must weigh these priorities against their concerns over future interest rates, inflation, government debt, and other factors that might affect fixed income returns.

Striking this balance can be a challenge in any market environment, but especially now, as low interest rates have sent many investors on a quest for higher-yield bonds or alternative investments. Depending on your approach, this pursuit of yield may invite more risk—some of which may be hard to see or understand.

So, what’s an investor to do? How can you make prudent fixed income decisions while also addressing today’s low interest rates?

Clearly Defined Goals

The same core investment principles apply in any market environment. One key principle is that in a well-functioning capital market, securities prices reflect all available information. Today’s bond values reflect everything the market knows about current economic conditions, growth expectations, inflation, Fed monetary policy, and the like. So, according to this principle, the possibility of rising interest rates is already factored into fixed income prices by market participants with their own money at stake.

This is one reason investors should view future interest rate movements as unpredictable. Even the market experts who have access to vast amounts of research have a hard time predicting the direction of interest rates. For instance, despite regular predictions of rising interest rates over the past two years, nominal yields on US Treasuries and longer-term bonds have continued falling and now are at historic lows. Rather than trying to predict macroeconomic forces that are difficult to foresee, investors can look to the market to set prices and focus on the variables within their control.

Fixed income choices should follow investment objectives that define the role of fixed income in a portfolio. The portfolio can then be customized to meet those specific goals while managing tradeoffs. Objectives could be to preserve capital, manage overall portfolio volatility, match future liabilities, or maximize total return. Investors with different objectives typically have different tradeoffs regarding risk, expected return, and costs and each may be better implemented with differing types fixed income investments.

Know What You Own

Strive for transparency in a portfolio. Consideration should be placed on an investment manager’s basic strategy and how it relates to your objectives. The strategy will include knowing how the investments held in the portfolio might respond in different economic, market, and interest rate scenarios.

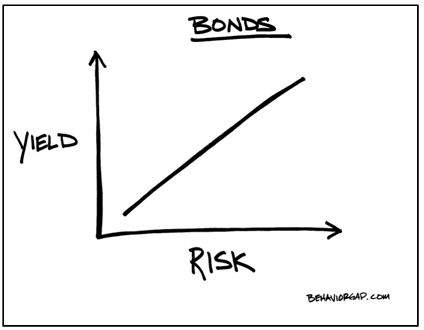

Unfortunately, investors often make their investment decisions based on the past performance and perceived popularity of the strategy. For example, some of the mutual fund categories experiencing the heaviest inflows of cash in the industry are in funds investing in asset groups that have recently experienced higher yields such as high yield bonds or bank loans. Yet, higher yields are accompanied by higher risks.

When reaching for higher yield, investors should carefully consider the potential effects of their decisions on expected portfolio performance and risk. In the fixed income arena, investors have two primary ways to increase expected yield and returns on bonds. They can extend the overall maturity of their bond portfolio or hold bonds of lower credit quality. These may be reasonable actions. But pursuing higher income means accepting more risk, as measured by interest rate movements, price volatility, or greater odds of losing value if the issuer defaults.

Other Considerations

Investors typically do not realize that investment-related costs determine a large part of a portfolio’s yield and return. This applies especially to fixed income securities. In fact, research has shown that a bond mutual fund’s expense ratio helps explain much of its net performance—and funds with the highest expenses tended to have the lowest performance within their peer group. Purchasing individual bonds escape a fund’s expense ratio but carry commissions and opaque spread costs, if purchased in the secondary market, and may lack diversification.

Investors have other tools to enhance risk and expected returns in fixed income. You can expand your opportunity set by moving beyond your domestic fixed income market to access yield curves in other country markets. By owning bonds issued by governments and companies from around the world, investors can enhance diversification in their fixed income portfolios. After hedging against currency risk, bond markets around the world have only modest similarity as measured by correlation. As a result, a global hedged portfolio should exhibit lower volatility than a single-country portfolio or a global portfolio that does not hedge currency risk, and offer the opportunity to take advantage of more attractive yield curves abroad.

No one really knows when and by how much interest rates will change. Many market pundits have forecasted an upward move for several years now. Investors looking for higher bond yields should understand the higher risks tied to their decisions. Most investors might be best-served by building a fixed income strategy to complement their broader portfolio objectives, understanding the sources of risk and expected return, paying attention to fees, and looking beyond their own country to capture yields in other countries’ markets.

Kevin Kroskey, CFP®, MBA is President of True Wealth Design, an independent investment advisory and financial planning firm that assists individuals and businesses with their overall wealth management, including retirement planning, tax planning and investment management needs.