The Tax Cuts and Jobs Act of 2017 (TCJA) has passed and immediate action before year end 2017 is likely required to save on your taxes. TCJA had most profound impact on business taxes, given the permanence of corporate tax reform versus individual reforms sunsetting after 2025. However, we’ll focus on how the reforms impact individual tax payers and common client scenarios.

Tax Rates and Brackets

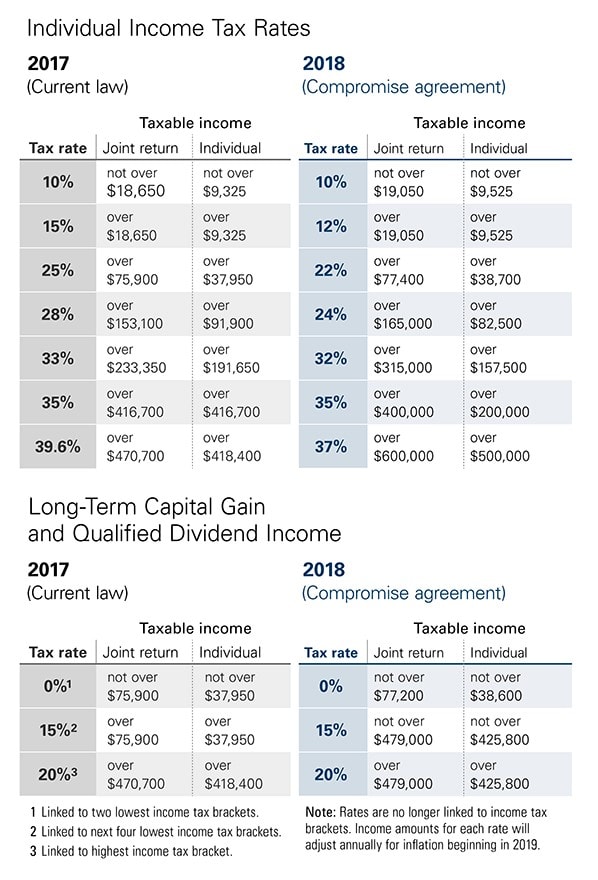

The good news is we will have lower rates on income, beginning in 2018. Seven brackets have been retained, and a table showing 2017 vs. 2018 rates and income ranges is below courtesy of Vanguard. While income tax rates have decreased brackets have also been expanded. For example, those married filing jointly with taxable income ranging from $165,000 to $315,000, the marginal tax rate is 24%. Previously the 28% bracket begin at $153,000 and increased to 33% at $233,000 of taxable income. This is quite a favorable increase for taxpayers in this range.

Rates on long-term capital gains and qualified dividends have remained the same and continue to operate on a tiered system, ranging from 0% to 15% to 18.9%* to 23.9%*. The change here is that these rates are no longer tied to tax brackets but instead are delinked and will increase according to inflation. (*Note the 3.8% Medicare tax on the net investment income of taxpayers with a modified adjusted gross income over $250,000 for married couples or $200,000 for individuals has been retained).

Deductions & Exemptions

While taxes were not simplified in relation to income tax brackets, simplification was achieved when it comes to deductions. Simplification also produces winners and losers.

The standard deduction amount increases for taxpayers in 2018 to $24,000 for married couples filing jointly ($12,000 for individuals) up a whopping $13,000 from what was scheduled for 2018 under prior law.

On the other hand, personal exemptions have been eliminated. This negatively affects larger families that would have an exemption of $4,050 for each person in your household. (Although the child tax credit increase from $1,000 to $2,000 per child and applying at much higher income thresholds up to $400,000 makes up for this.)

Below are comments on each deduction you may currently have on your Schedule A. You’ll see a common thread that it will likely make sense to prepay deductible expenses before 12/31/17. Of course, these are general comments. Consult your advisor regarding your personal situation.

1) Medical Expenses

The medical expense deduction generally applies to retirees who pay insurance premiums with after-tax dollars. While working, premiums are deducted pre-tax from your pay, and the IRS doesn’t allow double-dipping.

To be able to deduct medical expenses, your total out of pocket costs must exceed 10% of your adjusted gross income for taxpayers under the age of 65. The new law reduces the percentage for all taxpayers to 7.5% for 2017 (yes retroactive) and 2018. In 2019, it will revert to 10%.

Recommendation: If you can deduct medical expenses in 2017 but may not be itemizing in 2018, prepay any you can in 2017.

2) State and Local Tax (SALT) Deductions

The change in these deductions will have a significant impact on many high-income taxpayers in Ohio and similarly taxed states and will also be the primary reason many take the standard deduction rather than itemizing. The overall deductible limit for 2018 is limited to $10,000. This limit applies to a combined total that will include state and local income taxes, real estate taxes, sales tax, personal property tax, etc.

For example, assume you are a professional earning $200,000 in Akron, OH with a local tax rate of 2.25%. For state taxes you pay approximately $7,500 and another $4,500 for local. You live in a house and pay property taxes of $8,000 yearly. Collectively, you had $20,000 in deductions but now those are limited by half. (Although this is true, these same deductions often caused a client in this situation to be in the Alternative Minimum Tax or AMT. The AMT has been substantially modified and will not ensnare as nearly many taxpayers going forward.)

Recommendation: If you are itemizing in 2017, it is generally a good idea to prepay any state income tax you are likely to owe come tax filing before year-end 2017. The tax bill specifically precludes prepaying 2018 state taxes in 2017. However, even if you overpay your 2017 state taxes substantially and get a refund, you may still maximize your itemized deductions. Then you must claim the refund as income in 2018 … at lower tax rates, which is a win. (Note: if in AMT in 2017, this does not apply.)

3) Real Estate Taxes

Again, real estate taxes will fall under the state and local (SALT) limitations, beginning in 2018.

Recommendation: Most will benefit from prepaying their 2018 real estate taxes prior to December 31, 2017. Search online for your county auditor, and send a check for the amount you paid in 2017 with a note you are prepaying for 2018. Be sure to include your permanent parcel number (PPN). You can find your PPN on the auditor’s site by searching for your property. (Note: if in AMT in 2017, this recommendation does not apply.)

4) Mortgage Interest

The mortgage interest deduction was retained but modified.

As of December 15, 2017, there’s a limit on acquisition indebtedness – your mortgage used to buy, build or improve your home – of $750,000. For mortgages taken out before December 15, 2017, the limit is $1,000,000. Then in 2027, the cap goes back up to $1,000,000, no matter when you took out the mortgage unless additional legislation is passed.

For tax years 2018 through 2026, there is no deduction available for interest on home equity indebtedness. Previously there had been a $100,000 limit (though this did not apply to those in the AMT). So, if you use your home equity line of credit to buy a car, no deduction available. However, if you use your home equity line of credit to improve your home and add a deck, well that’s deductible as acquisition indebtedness.

Confused? Do not have good records on all the improvements you made over your lifetime of homeownership? While these are the rules, pragmatically, you likely don’t have proper records, the rules are difficult to enforce, and your tax preparer takes the path of least resistance.

Tax preparers generally take your 1098 mortgage interest statements and put the full amount on your Schedule A. Even if they are aware of the differences in deductibility of acquisition and home equity indebtedness (many aren’t), I doubt those words ever entered the conversation during your return preparation.

5) Charitable Donations

Charitable donation deductions were retained.

Recommendation: If you’re not likely to itemize your deductions in 2018 consider making last minute donations before year-end. You could also make a contribution to a donor advised fund and take the deduction this year and then make distributions from the account to the different charities in future years.

Charitable IRA Rollovers (technically called Qualified Charitable Distributions or QCDs) will also become even more advantageous going forward. Since most will not be itemizing, this will allow you to avoid having taxable income from an IRA hit your tax return. Then you still retain the full standard deduction against other income.

6) Miscellaneous Itemized Deductions

Miscellaneous itemized deductions have been eliminated. The were previously deductible over 2% of AGI for taxpayers not in the AMT.

Recommendation: If you can itemize these miscellaneous deductions in 2017, prepay any 2018 expenses you can. They typically include unreimbursed business expenses (job travel, professional dues, job-related education), tax preparation and investment advice fees*. (*Note: investment advice fees related to tax-deferred IRAs will continue to come out pre-tax from the account, which is preferable and more efficient than a tax deduction, and likely comprise the majority of your fee.)

7) Phaseout of Itemized Deductions

For high income taxpayers, deductions began to phaseout at a rate of 3% for every $1 over a certain adjusted gross income threshold of ~ $300,000. This amounted to ~1% marginal tax rate increase. The overall limit on itemized deductions is suspended for the tax years 2018 through 2026.

Recommendation: If you are north of $300,000 and planning to make a large charitable contribution before year-end in 2017, it’s possible the deduction may be more valuable in 2018 — counter to other recommendations above — even though tax rates will be less. Your advisor needs to run the numbers.

Roth IRA Conversions

In general, we like Roth IRA conversions – moving money from a pre-tax IRA to a tax-free Roth IRA and paying tax on the amount moved – for clients who can realize income in a low bracket (relative to what they can expect in the future) and have the funds to pay the tax from outside of the IRA. This tax planning is often most valuable to new retirees up through age 70 and helps to maximize after-tax wealth over time. With the lowered tax rates for the next several years, conversion strategies become even more attractive.

The new law, however, has eliminated the ability to undo (called recharacterize) conversions. This will kill the ‘advanced Roth strategy’ we successfully utilized for several clients over the last several years. Further, the bill is ambiguous as to whether 2017 tax-year conversions can be recharacterized in 2018. We will be cautious and prepare and forward paperwork to affected clients to perform recharacterizations before year-end. We will execute the paperwork on Friday, December 29th, if no clarification has been provided.

Due to the elimination of the recharacterizations, performing a current-year tax projection and only converting an amount to fill up the targeted bracket(s) will be very important going forward.

Summary

A differentiator for True Wealth Design is complete integration of our client’s financial lives to support the life goals they have. Most advisory firms just focus on investments and may add in low-level retirement planning at best. We instead have the expertise and services available to consider all aspects of our client’s financial lives.

The integration of your goals into a well-thought, high-level retirement plan matched by an investment plan and brought down to the micro level of tax and cash-flow planning is what we do. Tax reform impacts you on these micro levels, which then feed back into the big picture planning. So if you don’t understand taxes, not only do you likely pay extra, you lack understanding on your cash-flow planning, which likely means your long-term retirement plan is missing the mark.

Tax reform included many additional provisions though key ones affecting most of our clients are discussed above. Tax reform creates winners and losers. Most taxpayers will be winners, and we will help ensure our clients win as much as possible. Your action may be required before year-end 2017 to help you do so. Please contact us with any questions.

Post Script:

Perhaps the most interesting and unanswerable question (at least in the short run) is how much of the $1.47 trillion cost of these reforms our country will incur over the next ten years will be paid for by economic growth. We have seen well-reasoned estimates of 1/3 to 2/3 could be offset by growth.

To see an analysis from the non-partisan Tax Foundation, see here:

Tax Foundation: Preliminary Details and Analysis of the Tax Cuts and Jobs Act