2022 has been a tough year for investors. Through the end of May, the S&P 500 and the Bloomberg U.S. Aggregate Bond indices have declined at -12.8% and -8.9%, respectively. Both stocks and bonds, which is what most investors predominantly own are down at the same time. Double ouch.

Trend following – or what Morningstar calls “Systematic Trend” – is a bright spot in 2022 with the Morningstar systematic trend category average +16.0% through May. Most readers right now are asking ‘what is systematic trend’, as it’s not a commonly utilized investment strategy.

What & Why of Trend

Systematic trend strategies invest across geographies and assets, including equities, fixed income, commodities, and currencies. You already own similar assets in your portfolio, but in trend following, they are used in a strategically different manner.

Traditional investments in any of these markets typically would be more long-term in nature and profit only if the price increases. However, when used in trend following, these assets are used in the hopes of profiting from shorter-term price trends. If a strong positive price trend exists, those assets will be owned (long). If a strong negative price trend exists, the strategy will sell those assets (be short). Thus, the strategy may profit in up and down markets.

The diversification benefits of trend are evident. The SG Trend Index has shown little correlation to both stocks and bonds. Recall that a measure of diversification is having assets that move in a dissimilar fashion or are non-correlated. You can think of an example as owning a mountain-side business that sells skis for the winter and bikes for the summer. Having both to sell diversifies the business, smoothing the revenues.

Since 2000, stocks and bonds have exhibited slight negative correlation, yet this isn’t always what to expect. The last time this occurred was in the period 1950-1965. However, from 1965-2000 and for a majority of U.S. history, they generally moved in the same direction – being positively correlated. This too has been the case in 2022 with both going down in unison. Thus, the non-correlation of trend to stocks and bonds may be especially valuable today.

In the inflationary environment we’ve been in, increases in commodity prices and interest rates have exhibited strong trends and contributed to the positive performance of trend-following strategies in 2022. With equity markets trending sharply down more recently, many trend strategies are short stocks. Thus, trend may help in sustained equity market sell-offs too.

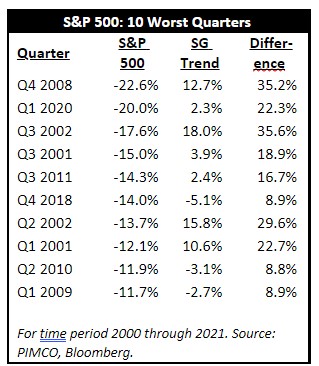

In fact, we see this relationship in the historical data. The SG Trend Index has, on average, been negatively correlated to stocks in quarters where stocks have declined. You can see the performance of the S&P 500 Index for the 10 worst quarters since 2000 and the SG Trend Index’s performance during those same quarters in the table. On average, trend has outperformed by more than 20% during those quarters.

Trend following is not a strategy to own for the uniformed or impatient investor. The strategy does best when markets exhibit persistent trends, when they are going from good to great or bad to worse. But if the market lacks clear trends or has had sharp reversals, trend following does not work as well.

Given trend following’s desirable diversification traits, properly including it in your portfolio may reduce both the volatility of your portfolio and reduce the maximum drawdown of your portfolio. Said another way, it should improve the risk-adjusted returns of your portfolio. And while having it in your portfolio at all times is likely advisable, it does seem we will likely remain in an economic and market environment where its diversification benefits will be particularly valuable.