I’ve been writing this article since January 2011. At that time, we were recovering from the Financial Crisis with perpetual alarms from pundits for a “double-dip recession,” concerns over growing U.S. deficits, and homeowners feeling trapped under depressed housing prices that had yet to recover in earnest. Oh, we also had the BP oil spill, Greek debt crisis and concerns over the Euro collapsing.

And just a few months later July 2011, the U.S. would nearly default on its debt, causing S&P to downgrade U.S. debt from Triple A rating status, as Congress wrangled over the debt ceiling. Previously the ceiling had been raised without debate.

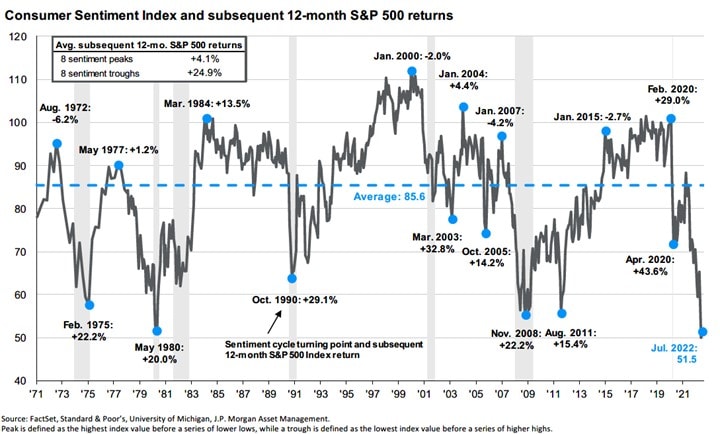

With a list like this, it is easy to see how optimism was in short supply for investors at that time. The University of Michigan’s Consumer Sentiment Index did in fact reach a low in August 2011. And this low was recently eclipsed in July 2022.

Looking back further in time, you may be somewhat surprised that predictions by many smart, renowned people, warning of a bleak future are common. (Note: I’m not concerned about the more recent explosion of bleak predictions from malinformed conspiracy theorists for what I hope are obvious reasons.) Author Matt Ridley illustrated several examples in his 2010 book The Rational Optimist. For instance, Thomas Robert Malthus, a contemporary of Adam Smith in the late 1700s, wrote that an increasing population would cause a “Malthusian Trap”, arresting advances in quality of life. In the 1960s, Stanford University professor Paul Erlich’s best-selling book, The Population Bomb, warned of mass starvation that was to come in the 1970s and 1980s. Or recall the Y2K scare from the late 1990s that purportedly had the potential to bring down worldwide infrastructures for industries ranging from banking to air travel, causing some to withdraw large sums of money from banks or purchase backup generators among other apocalypse-avoiding measures.

It’s not that these weren’t real issues. They were. However, they may have been blown out of proportion, overcome or both. As Bill Gates wrote in his review of the book published in the Wall Street Journal, “Despite them, our lives have improved dramatically in terms of lifespan, nutrition, literacy, wealth, and almost any other measure you’d care to name.”

The human brain essentially precludes us from seeing nonlinear change—from seeing innovation—even though in hindsight history shows us it happens all the time. Gates remarked, “Pessimism is so often wrong because people assume a world where there is no change or innovation. They simply extrapolate from what is going on today, failing to recognize the new developments and insights that might alter current trends.”

The famed Austrian economist and Harvard Professor, Joseph Schumpeter, showed in the mid-1900s that the process of innovation in open markets transforms economies, destroying old business models and jobs while replacing them with new ones. This process has been coined creative destruction and is the essence of how markets work. Granted the process can be painful if you are on the destructed rather than the constructed side of change. Regardless, the world will continue to change, and thus change need be embraced. Believing otherwise will eventually cause disappointment.

Interestingly, while innovation and nonlinear changes are rooted in markets and capitalism, most economic models ignore nonlinearity, use extrapolation, and assume equilibrium. Equilibrium economics emphasizes determinacy, deduction, and stasis – all traits of linear thinking. And these economic models are commonly used by economists, policy makers, asset managers, and investors to influence their decision making.

Yet the world is complex and nonlinear over time. A more recent economic school of thought called Complexity Economics emphasizes contingency, indeterminacy, sense-making, and openness to change. As I learned about Complexity Economics more than a decade ago, it was clear to me this was a better way to think about the world, economics, and investments and accept more uncertainty than I’d prefer. Since then, I’ve asked many economists and asset managers how Complexity Economics is incorporated into their models, thinking, and decision making. While a minority were informed on the topic, none have responded that it is incorporated. Changing your thinking is often an evolution.

This change in thinking reminds me of my undergraduate college years when I studied Physics. After taking Classical Physics, my Modern Physics professor stated on the first day of class, “Now forget what you learned in Classical Physics and get ready to bend your mind.” Nonlinear indeed.

It wasn’t that classical physics was completely wrong. It just didn’t tell the whole story. Same goes for the economic theory comparison.

The future has always been better because of innovation. It is irrational to portend persistent societal decline when history shows us the exact opposite to occur. It is rational to be long-term optimistic. In the next article we’ll explore how this should influence your investment portfolio.

Kevin Kroskey, CFP®, MBA | Managing Partner September 2022

PS: From the table you may have noticed that the consumer sentiment index turns out to be a contrarian indicator. From 1971 through July 2022, S&P 500 returns (ignoring dividends) over the proceeding 12 months are +24.9% after lows are reached and +4.1% after highs are reached. When it feels bad it is often a good time to invest.