Two years ago, the New York Times reported, “Federal Reserve officials are increasingly worried that inflation is too low and could leave the central bank with less room to maneuver in an economic downturn.”1

More recently, a Wall Street Journal article presented a sharply different view, with a headline that likely touched a raw nerve among investors: “Everything Screams Inflation.” The author observed, “We could be at a generational turning point for finance. Politics, economics, international relations, demography, and labor are all shifting to supporting inflation.”2

Is inflation headed higher? In the short term, it has already moved that way. With many firms now reporting strong demand for goods and services following the swift collapse in business activity last year, prices are rising—sometimes substantially.

But is the inflation increase a negative? It depends on where one sits in the economic food chain. Airlines are once again enjoying fully booked flights at higher prices, and many restaurants are struggling to hire cooks and wait staff. We should not be surprised that airfares and steak dinners cost more than they did a year ago.

Do these price increases signal a coming wave of broad and persistent inflation or just a temporary snapback following the unusually sharp economic downturn in 2020? We simply don’t know for certain. However, markets do provide us information.

Evidence

Future inflation is one of many factors that investors consider. The market’s job is to take positive information – both positive and negative – to arrive at a price every day that both buyers and sellers deem fair. As of August 5, 2021, bond markets have inflation expectations at a modest 2.4% annualized over the next ten years and a tad higher at 2.6% annualized over the next five years. Does this sound like runaway inflation to you?

The past three decades have been a period of relatively moderate inflation in the United States with the annual increase in the consumer price index averaging around 2.3%. So current expectations are in alignment with the recent past, supporting Federal Reserve Chairman Jerome Powell statements on the transitory nature of recent price increases.

Some of the recent concern regarding inflation appears linked to substantial increases in government spending and the US debt load. Determining the appropriate level and worthiness of government spending is a contentious public policy issue. But these concerns are not new, and the expected consequences of these issues are likely already reflected in current prices.

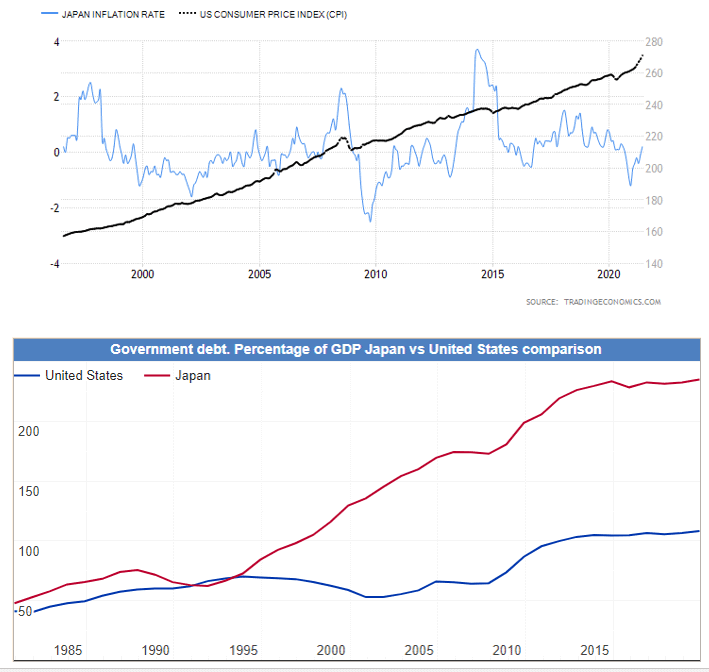

Objectively, we can look to Japan as an example of a modern, developed economy with a heavy debt load. While the U.S. has reached an all-time-high debt-to-GDP ratio of approximately 130%, Japan handily beats us, weighing in at more than 250%.

Has Japan had runaway inflation? Quite the contrary. Japan has had near zero inflation over the last decades while often fighting periods of deflation.

And while inflation has been low in the U.S. and Japan over the prior decades, perhaps unsurprisingly, it has been relatively lower throughout the rest of the world. Why? Over the prior decades we have had lower input costs for products and services through globalization. And technological advancements have increased productivity, further limiting price increases. Perhaps future productivity gains will be a decreasing rate than the past but technology will undoubtedly continue to evolve and improve.

The future is always uncertain. But as economist Frank Knight observed 100 years ago, willingness to bear uncertainty is the key reason investors have the opportunity for profit.3 Investors will always have something to worry about, and the media headlines will get more clicks if they are sensational. Yet, the possibility of unwelcomed or unexpected events should be addressed by the portfolio’s initial design rather than by a hasty response to stressful headlines in the future.

Kevin Kroskey, CFP®, MBA | Managing Partner August 2021

This article adapted with permission from Dimensional Fund Advisors.

1Jeanna Smialek, “Fed Officials Sound Alarm Over Stubbornly Weak Inflation,” New York Times, May 17, 2019.

2James Mackintosh, “Everything Screams Inflation,” Wall Street Journal, May 5, 2021.

3Frank H. Knight, Risk, Uncertainty and Profit (Boston and New York: Houghton Mifflin Co., 1921).