As I write this on March 5, 2020, COVID-19 is causing waves in global economies and markets. Over the last eight trading days, the S&P 500 sold off by more than 3% on four days but also bounced back sharply, rising more than 4% on two days.

While initial indications of COVID-19’s impact on economic activity and corporate earnings are filtering in, it’s still far too early to assess the ultimate effect. Markets dislike uncertainty. It’s uncertainty that is driving recent volatility in stock prices.

Some may even be tempted to sell and wait in cash or make some other knee-jerk reaction. Selling may alleviate fears temporarily but also tends to destroy wealth. It’s essential to understand why and to revisit your investment strategy.

Tactical Asset Allocation

Tactical asset allocation is a strategy in which an investor takes an active approach that tries to position a portfolio into assets, sectors, or countries that show the most potential for perceived gains. Tactical strategies are traded more actively and are based on price trends, momentum, or economic forecasts. They may be free to move entirely in and out of their core asset classes and go to cash. Tactical Asset Allocation is also called “Market Timing.”

Market timing sounds appealing and is an easy sell to unknowledgeable investors. Who wouldn’t want to avoid down markets but participate in the upside? The problem is there is no empirical evidence to support that it is likely to work. No evidence should equal a no-go for your hard-earned money.

While there are many reasons for market timing not working, one of the most evident is volatility. Short-term market movements are noisy and unpredictable. You can see that in the recent daily returns.

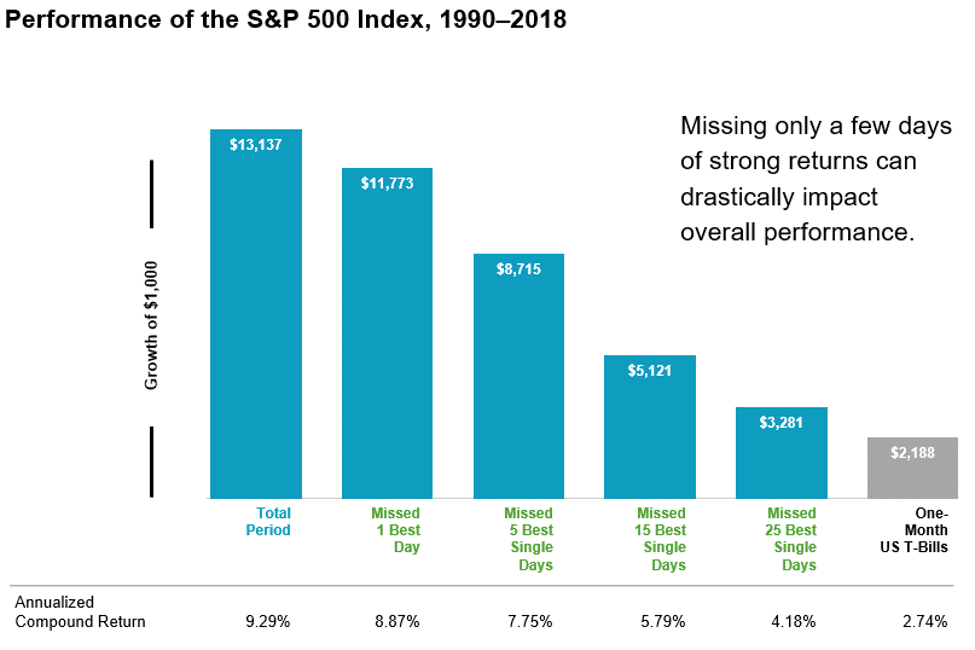

Or consider that from 1990 through 2018, the S&P 500 delivered a 9.3% annualized return. If you missed only the 15 best days, your annualized return would have been just 5.8%. Do you know which days will be best or worst in advance? When to get out and then back in?

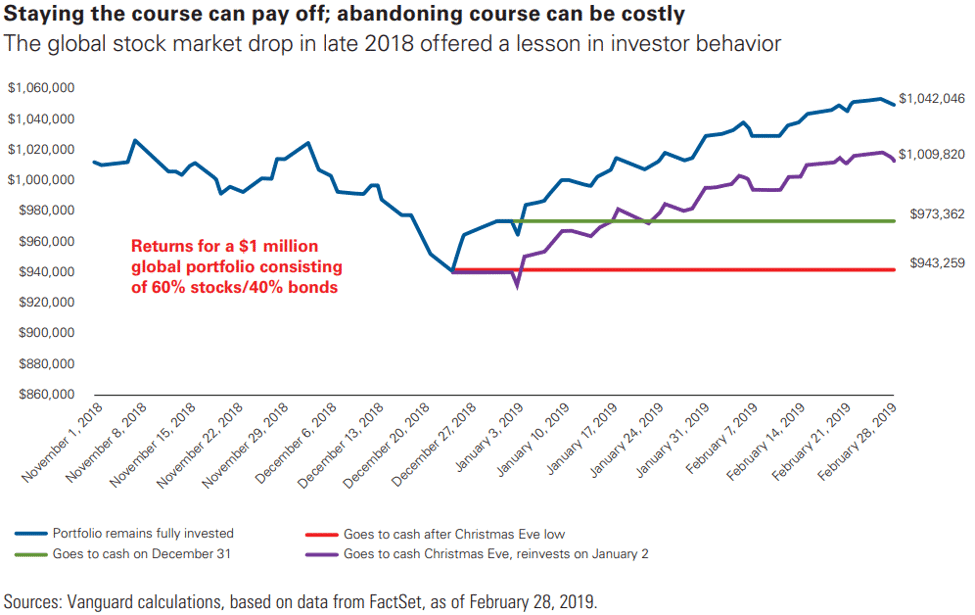

Consider the last time we had a material sell-off in late 2018. A hypothetical 60% stock and 40% bond portfolio that stood at $1 million on November 1, 2018, would have lost 5.7% of its value by Christmas Eve.

Yet selling at that time and going to cash just for one week and then reinvested on January 2 would have cost you more than $30 thousand as of the end of February compared to only staying invested.

More Evidence Against Market Timing

Consider the 2014 study, The Real-Life Performance of Market Timing with Moving Average and Time-Series Momentum Rules. While I’m sure it sounds like a thrilling read you just added to your list, let me provide the conclusion.

“We revisit the myths regarding the superior performance of market timing strategies based on moving average and time-series momentum rules. These active timing strategies are very appealing to investors because of their extraordinary simplicity and because they promise substantial advantages over their passive counterparts. We find the reported performance of market timing strategies usually contains a considerable data-mining bias and ignores important market frictions (transaction costs). Our findings reveal that the performance of market timing strategies is highly overstated, to say the least.”

More concretely, the authors found that the failure rate of the common timing strategies was about 80%.

Data mining bias, you ask? For those not informed, let me provide an example. Suppose you rank stock returns sorted by company name. You find companies whose name starts with the letter “P” have higher returns than those that begin with the letter “M.” Eureka! You have identified a clear winning strategy … right?

As you can see, the investment strategy has no merit. Instead, it’s merely a past pattern you identified in stock prices. What reasonable basis do you have that the trend will persist in the future and provide you higher returns? I pray you just said, “none.”

That’s data mining. That is what technical analysis and market timing strategies do. It may sound fancier. It certainly looks appealing to the uninformed. But it’s data mining at the core. It’s not science. I’ll stop short of calling it snake oil, but it’s darn close.

Prefer not to consider academic, theoretical evidence? Want to get out of the ivory tower and talk about the real world? Well, let’s look at mutual fund evidence.

Morningstar classifies 250 funds in their Tactical Asset Allocation category as of February 2020. These funds are professionally-managed with intellectual talent, deep resources, and sophisticated models to time their moves. How have they faired?

To examine this, consider that these funds generally have a risk level similar to that found in Morningstar’s “Fund Allocation 50-70% Equity” category. So mutual funds in this category have a range of 50% in stocks to 70%, and their similar risk profiles make for a valid risk/return comparison. In comparing the average return of the 50-70% equity category to the fund returns in the Tactical Asset Allocation (TAA) category, we find 78% of the TAA funds underperform over the last three years and 89% over the previous five years.

Going back to 2014, there were more than 340 funds in the TAA category. If you add back these now defunct funds (because they were losers), the underperformance is even greater. These are quite poor results versus staying invested.

And these are the professionals – the professionals that have their returns accurately tracked and reported to the S.E.C. – not some hype you hear on CNBC, in an investment newsletter, or at the golf club about some supposed guru.

What To Do

COVID-19 will undoubtedly continue to evolve and spread throughout the U.S. Health experts are currently expecting the peak to occur in May-June of this year.

There will undoubtedly be supply chain disruptions and lower demand, particularly in the leisure and travel sectors of the economy. This sector, however, only comprised about 3% of U.S. GDP. Yet, spillover effects on the broader economy will occur.

What we also know is that this too shall pass just as other virus outbreaks have. It may not be until late this year, but it will pass.

What we don’t know is how much economic harm will be born by the global economy and whether or not that is already fully priced into stocks. When and whether a v-shaped or u-shaped recovery is also unclear.

Yes, portfolio changes should be made during times like these. Realizing tax losses, adjusting your portfolio mix in light longer-term expected returns, or rebalancing back to your target percentages all may be appropriate. Yet those changes should be processed-based and not fear-based. Importantly, your portfolio should be married to your financial plan, and any living expenses in the short term should not be reliant upon stock returns.

Please beware of the seductive nature of market timing. Sophisticated market timing strategies have no empirical evidence supporting them. If the professionals cannot do it, why should you try?

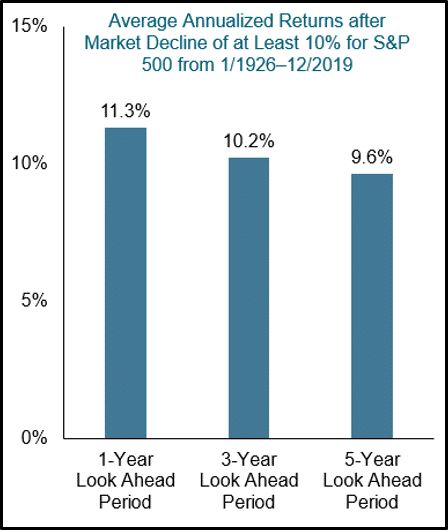

To end on a positive note, please keep in mind how the market tends to behave after a decline, shown in the graphic below.

Stay disciplined. Stay calm. This too shall pass.

Kevin Kroskey, CFP®, MBA | Chief Investment Officer

PS – Interested in learning how our disciplined, science-based investment strategy can help you tune out the noise and achieve your goals? Contact us for a 15-minute call to explore a relationship.