You worked hard. You saved and invested. Now you’re at the doorstep of retirement – at least you think you may have enough – and you wonder, “How the heck do I replace this paycheck I’ve been getting every two weeks for the last forty years?”

You are smart and realize that your retirement is not like your parents. They had a shorter life expectancy, better pension, and high interest rates and dividend yields. Their retirement planning was akin to the proverbial shooting fish in a barrel. Yours … well let’s just say there’s a lot more uncertainty.

Yes, you have money in accounts and some even have “retirement” in the name. But how is that supposed to translate to income?

Framework

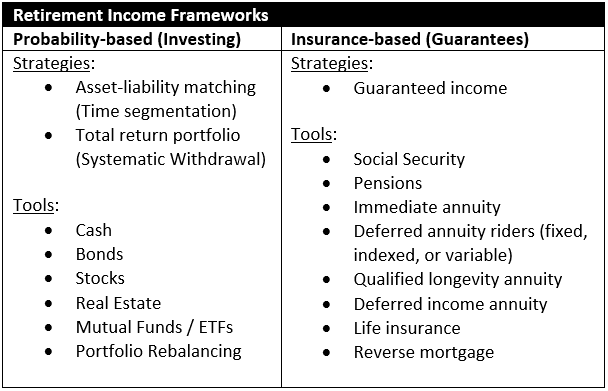

There are a plethora of strategies and products that can be used – some better than others – to derive retirement income. You can think of two basic differences: those that use investments and are probability-based and those that use insurance and generally have some underlying guarantee. You can see the summary table that helps to organize these frameworks and provides strategies and tools that generally fall within these frameworks.

While guarantees sound great – who wouldn’t want guaranteed retirement income – guarantees are often expensive. Utilizing guaranteed income strategies will often cause you to have to spend less throughout retirement or work longer. That can be quite a high price for some perceived peace of mind.

Since you either have Social Security, a monthly pension, or both, at least part of your retirement income plan will be insurance-based. This is because each have an underlying guarantee or promise to pay you an amount for your lifetime.

So, the question becomes: after you take care and diligence in analyzing how much spending is required for your desired lifestyle, and you make smart decisions on your Social Security and pension claiming strategies, should you pursue additional guaranteed income as part of your overall retirement income plan? Or, is there a better way to create the additional income required to meet your lifestyle goals that may not be guaranteed but gives you a high likelihood of reaching them?

Process, Biases & Evidence

Financial professionals often will have a bias towards various strategies and products. Sadly, commissions often drive the recommendations – especially on the insurance-based side. And neither side is universally correct.

Rather, just like your mom always told you, you are a unique and special snowflake. Your income, assets, lifestyle, and risk preferences among a myriad of other traits are different from everyone else. Your uniqueness should then warrant a customized strategy for your optimal retirement income plan.

The process to optimize retirement income should eschew biases and look to science-based evidence to guide decision-making. Advantages and disadvantages of various strategies and tools need considered as does how to best combine them for you.

While you are unique, some guiding principles will result from this process. And this is what I will be writing about over the comings months to help you better understand the critically important retirement income problem. Stay tuned.