Chances are you know the difference between a traditional IRA/401k and a Roth. The gist is that contributions to a traditional IRA/401k are pretax but fully taxable upon distribution. Conversely, contributions to a Roth are made after taxes, but distributions are tax-free. If you convert from traditional to Roth, then you have to pay income taxes on the amount converted in the year of the conversion.

If you can pay a lower tax rate today than in the future, the Roth is generally advisable. On the surface you may have fewer dollars due to the taxes you must pay, but your purchasing power in after-tax dollars will be higher. 2020 is a year to consider a Roth Conversion and a multi-year strategy may even be better.

Why 2020?

The 2017 Tax Cuts and Jobs Act (TCJA) lowered tax rates and significantly widened tax brackets on individuals. For married couples in 2017, a 25% tax rate was incurred on taxable income over $75,900. In 2020, a 24% tax rate applies on taxable income up to $326,600.

Current law has the tax rates under the TCJA in effect through the 2025 tax year and reverting to pre-TCJA rates and brackets in 2026. So current law has significant tax increases already baked into the 2026 cake if no additional legislation is passed.

However, there is a risk that tax rates may go higher sooner. Many election models are currently forecasting Biden to win the electoral college and for the Senate to flip blue. Assuming these come to fruition, the Biden Tax Plan calls for tax increases to occur before 2026, mainly on higher-income households and corporations. A plan isn’t law but an indication if a November sweep occurs.

Then there are the trillions of dollars in unprecedented fiscal stimulus added to the government’s books to deal with the COVID crisis. At some point, the mounting debt has to be paid for, and various taxes are the way it must be paid.

Multi-Year Strategy

While 2020 may present an ideal year for many people to utilize the Roth, using the years between when a person retires and age 72 is particularly attractive. Once retired, you have no more taxable earned income. Social Security can start as early as age 62 but often is advisable to defer at least the primary earner’s benefit to age 70. Deferral provides a higher benefit and keeps income lower during the deferral period.

The tax rate during these early retirement years can be quite low, making yearly Roth conversions quite attractive. Doing so also reduces the required minimum distributions (RMDs) that start at age 72.

James Lange, CPA, and author of Retire Secure! provides an example.

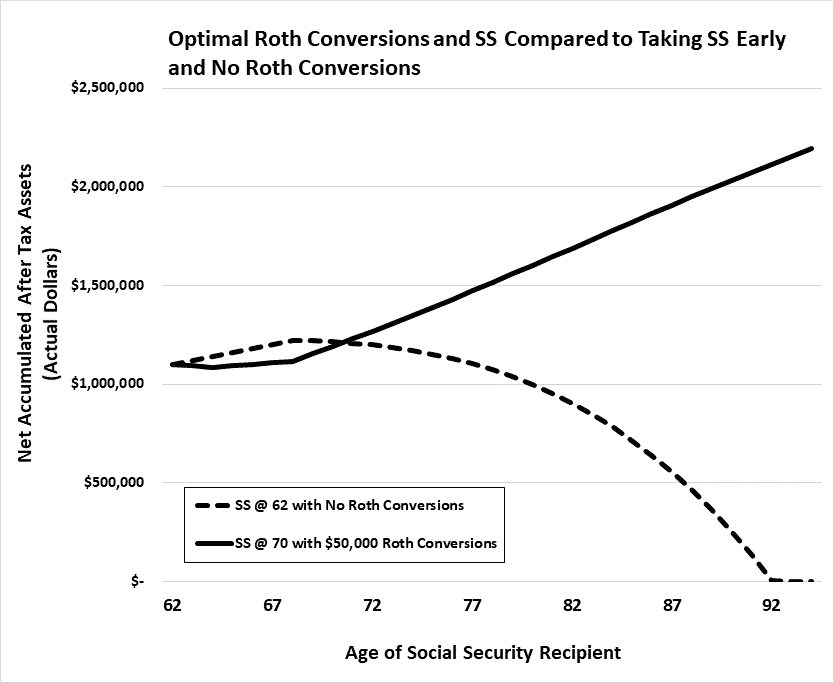

This graph shows that optimizing Roth IRA conversions and Social Security strategies versus collecting Social Security at age 62 and not doing any Roth IRA conversions will result in a difference of over $2,000,000 for this family.*

Now is the time for many to consider utilizing a Roth conversion. Having a financial plan in place to identify peaks and troughs in spending and income is required to evaluate current and expected future tax rates. Having the tax knowledge and skills to execute the strategy to targeted income levels is also required. Talking with a professional that can integrate your financial, investment, and tax planning into a cohesive strategy is a good first step to realize these potentially significant benefits.

*Graph assumes that the client has sufficient after-tax savings from which the tax on the conversion are paid. He makes Roth conversions in the amount of $50,000 every year for eight years, earns a 6% rate of return, and spends $75,000 annually with an annual 3.5% inflation increase.