Retirement planning literature has several commonly referenced rules of thumb. In my experience in helping clients plan for retirement and successfully manage their financial lives throughout their retirement years, I have found most rules of thumb apply only by chance. Even if the rules were right on average, that would imply they are right about half the time and wrong the other half. Would you like a 50% chance that you will get your retirement spending right?

The rule states that an initial spending rate of 4% from your savings and investments will be sustainable over your retirement and can be increased for inflation each year. For example, if you have $1,000,000 in your savings and investments at retirement, you can withdraw 4% or $40,000 in year one. Then in year two, supposing inflation is 3%, you can increase to $41,200 and so on.

Problems with the Spending Rule

This rule of thumb emanated from research done in the mid 1990s and is one I have the least issues when looked at in isolation. However, application in today’s market environment and in light of a retiree’s actual spending makes the rule of limited value.

Let’s start with actual spending. The rule assumes that spending increases each year throughout retirement by inflation. I have described in detail in prior articles that this is contrary to actual spending patterns of retirees. Rather, inflation-adjusted spending tends to decrease over time as retirees become more sedentary. If the assumption is changed to reflect declining spending, the research would have concluded a safe spending rate higher than 4%.

In addition, the safe spending rule is based upon historical U.S. stock and bond market returns dating back to the 1920s and identifies a spending level that would have survived even the worst case market scenario.

Yet, what if the market climate is not the worst case but average or even above average? The research showed that in some periods spending rates could be more than double the worst case. Would you prefer to spend $40,000 or $80,000? That is a substantial difference and may allow you to retire earlier or spend and do more to enjoy life.

Or what if past is not prologue and the historical market returns yield overconfidence in what you can spend in the future? For example, today’s low interest rates are not prevalent in the historical record. Thus lower rates equal lower returns from bonds and similar investments.

A 2013 study showed that low rates would cause the 4% rule not to be safe but fail more than 50% of the time. Another variation showed that if interest rates return to a historical norm over a 10-year period, the 4% spending rule still fails more than 30% of the time.

Further, research in 2015 showed the 4% rule was somewhat unique to the U.S. market. Looking world-wide the 4% rule failed in fifteen of twenty developed countries. Are you willing to bet history will repeat itself?

A Better Retirement Spending Plan

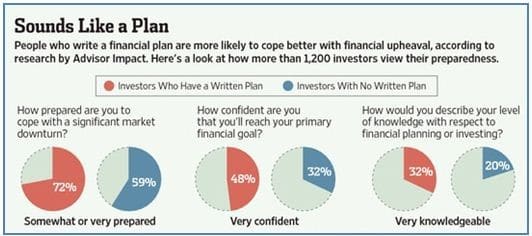

The best way for you to stay in the safety zone of retirement spending is have a sound retirement plan and to have a professional run the numbers at least every year in light of recent market activity and long-term guidelines. Converting a portfolio into a paycheck is a surprisingly complex exercise. Investment planning and tax planning also need to be integrated with your spending plan.

When it comes to creating income in retirement from your portfolio, a one-size-fits-all strategy may be a good place to start but is inadequate for most. There is no substitute for having a sound plan, regularly monitored, and with adjustments made as needed. This will best help you get the most from your money while ensuring it lasts your lifetime.

Kevin Kroskey, CFP®, MBA is President of True Wealth Design, an independent registered investment advisory and wealth management firm specializing in retirement, tax, and investment planning.