Morningstar: Measuring Increased Income

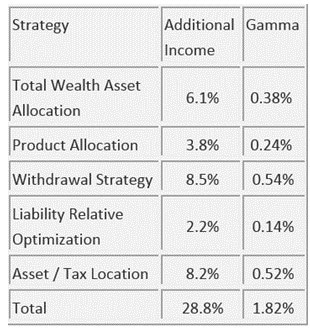

Both Vanguard, in Vanguard’s Advisor Alpha, and Morningstar, in Alpha, Beta, and Now … Gamma, recently released studies quantifying the benefits of working with a financial advisor. Morningstar studied the question by measuring something they called gamma – “the additional retirement income investors can generate by making better financial-planning decisions.” Therefore, gamma is the result of financial planning decisions rather than solely investment decisions.

What the research showed is that the ability to deliver extra income is predictable — unlike the ability to beat the market. Take certain steps — what Morningstar calls “following an efficient financial planning strategy” — and you achieve excess returns.

The five key decisions boil down to asset allocation, withdrawal strategy, tax-efficiency, product allocation (the use of traditional investment products versus guaranteed-income products), and liability-driven investing (investing to meet specified goals and cash flows over time).

Vanguard: Measuring Wealth Management

Vanguard, a long proponent of do-it-yourself investors, interestingly came out with their own study with many similarities but a few key differences to the Morningstar study. Vanguard added in behavioral coaching – keeping investors disciplined – but excluded product allocation. The value of behavioral coaching has long been documented and was estimated at 1.5% annually in the study.

Vanguard researchers wrote: “Advisors can potentially add about 3% in net returns by using the Vanguard (wealth management) framework. Because clients only get to keep, spend, or bequest net returns, the focus of wealth management should always be on maximizing net returns. It is important to note that we do not believe this potential 3% improvement can be expected annually; rather, it is likely to be very lumpy. Further, although every advisor has the ability to add this value, the extent of the value will vary based on each client’s unique circumstances and the way the assets are actually managed, versus how they could have been managed.

The last two sentences are just as profound as the quantification of the benefits in either study. You go to the doctor for check-ups when you are healthy and not just when you are sick. An ounce of prevention is often worth more than a pound of cure. Having an ongoing wealth management relationship is very similar and is focused on achieving outcomes over time and benefits received will be substantial in some years and not in others. Yet without an ongoing relationship, the prevention is often missed and the cost to cure substantial or even unattainable. This is why the hourly, ad-hoc model of working with an advisor does not work well.

Just because someone has an M.D. after their name does not mean they are a good doctor and just because someone is an advisor does not mean they will add the value described in both studies. You still need a competent, caring and objective advisor to truly deliver value over time.