Last month I wrote about how our collective future has always been better because of innovation. The famed Austrian economist and Harvard Professor, Joseph Schumpeter, showed that the process of innovation in open markets transforms economies, destroying old business models and jobs while replacing them with new ones. This process has been coined creative destruction and is the essence of how markets work. As investors, history has clearly demonstrated it is rational to be long-term optimistic, providing higher returns to investors that own companies (buy stocks) compared to those that lend to companies (buy bonds).

Yet, as with most things, this isn’t the whole story. This process that culminates in societal advances and growth can be painful if you are on the destructed rather than the constructed side of change. Here we’ll explore how this should influence your investment portfolio and specifically highlight what not to do.

Individual Stock Peril

Suppose you were alive in 1935 at the dawn of commercial air travel and your fairy godmother shared with you that this tiny sector of the economy would eventually become a gigantic industry with millions of passengers flying every year. What a gift! It’s like Biff getting the sports Almanac in Back to the Future.

What would your investment prediction be for industry pioneers such as TWA or Pan American? Stellar stock market returns perhaps?

While millions of passengers materialized, in the end the profits did not for these firms. Both went bankrupt and are no more. In fact, TWA had a trifecta of bankruptcies. Thus, predicting which ideas will be create lasting innovation does not ensure attractive returns.

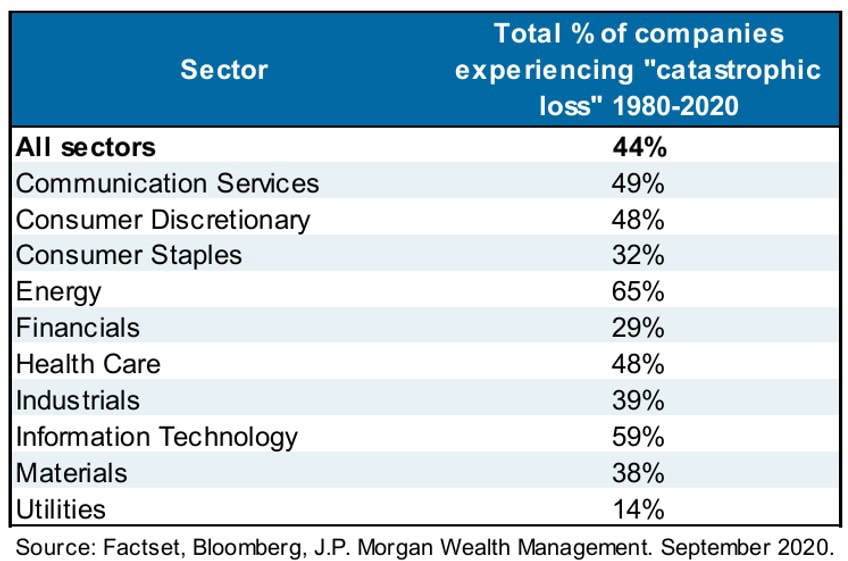

You can see the same in data on stock returns. JP Morgan recently updated a white paper entitled, “The Agony & the Ecstasy: The Risks and Rewards of a Concentrated Stock Position.” They looked at stock returns from 1980 through 2020 for the Russell 3000 Index, an index that measures both large and small U.S. listed companies. Over this time, the index returned a healthy 11.9% yearly.

Despite these stellar returns for the broader index, a whopping 66% of the stocks underperformed the index. Findings also showed that 40% of the stocks provided returns that were negative. Similarly, 40% of stocks experienced a “catastrophic loss,” defined as a 70% decline from peak levels and which is not recovered.

You can deduce that a majority of the positive returns were thus provided by a small number of stocks. The paper defined these as the “megawinners,” having a 500% cumulative price return in excess of the index, finding only about 10% of stocks were megawinners.

A similar study over a longer time period from 1926 through 2015 from Dr. Hendrik Bessembinder has similar conclusions with even more stark results: “When stated in terms of lifetime dollar wealth creation, the best-performing four percent of listed companies explain the net gain for the entire U.S. stock market since 1926, as other stocks collectively matched Treasury bills (cash).” He also found that the average stock was listed for just 7 years on average.

Pause for a moment and ask yourself: Am I confident I can pick the right stocks in advance of them having superior performance? (I hope, dear reader, that a sense of humility is resonating with you at this moment.)

If humility is not yet winning, let’s look to professional money managers. SPIVA – S&P Index Verse Active – is a regularly published report measuring how active investment managers fair compared to index returns. Active managers are attempting to select stocks that will outperform the benchmark over time. The 2021 yearend report found over the last three years, 72% of active managers underperform in absolute terms and 80% underperformed when measured by risk-adjusted returns. For the 10-year period, 86% underperformed on an absolute basis and 93% on a risk-adjusted basis.

If the probabilities are not in your favor and there’s no evidence the professionals can trump the probabilities, why would anyone attempt the same?

What To Do

The paper was titled well: the agony and the ecstasy. It’s a befitting description for the creative destruction process and for investors that attempt to select stocks in a concentrated form. Probabilities show you will experience agony in doing so. The ecstasy is simply a luck factor. And what rational person would invest their life savings on a foundation of luck?

Rather, diversification is a better path. Diversification done right is not simple and diversification is not just owning stocks and bonds. We’ve all seen in 2022 that can be insufficient. Rather, a more diversified, all-weather portfolio strategy is more prudent. Perhaps 2022’s learning lesson will propel you to take action to get a second opinion on your portfolio strategy and move forward with a more prudent, probability-based rather than luck-based portfolio.

Kevin Kroskey, CFP®, MBA | Managing Partner October 2022

See Also:

Ep 67: Beyond Diversification: Terminal Wealth Dispersion – True Wealth Design (February 2021)