We wrote in July 2019 that a bill known as The SECURE Act was likely to become law since it is one of the only things Congress had bipartisan support for these days. This legislation has become law as of 2020 after being attached to a spending bill.

The legislation significantly impacts some IRA owners. Here are the top changes, who is impacted, and what to do.

Key Changes

IRA contribution age limit removed. Under the new law, people with earned income beyond age 70.5 may now make IRA contributions. This simply aligns IRAs existing laws applied to Roth IRAs and 401k plans.

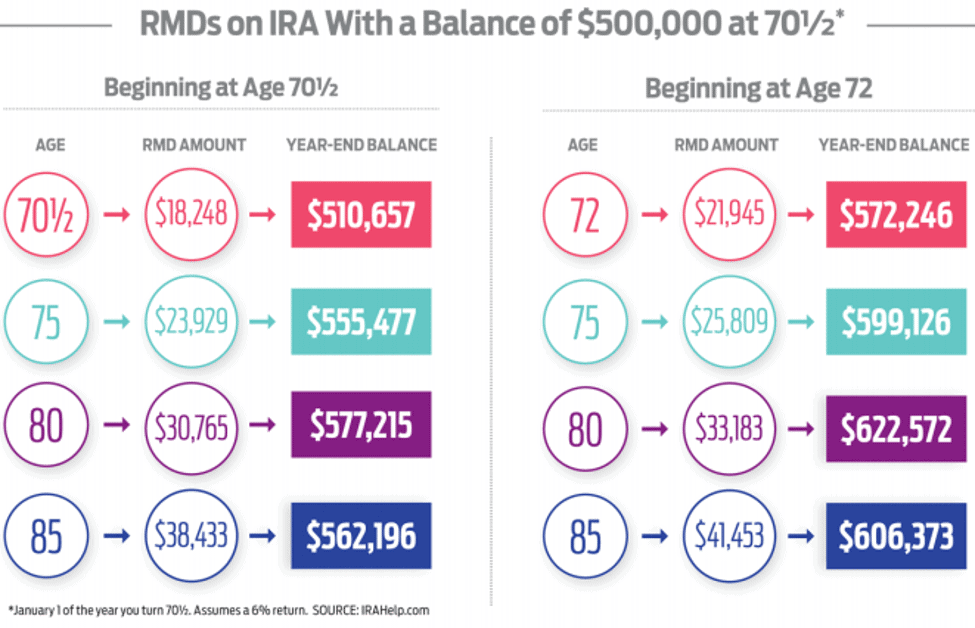

Required minimum distributions (RMDs) start at age 72. Prior law had RMDs starting at age 70.5. The additional 1.5 years isn’t a significant increase but may allow for an additional year or two of increased tax-planning flexibility. Those who reached age 70.5 in 2019 will need to withdraw their RMDs in 2020.

Elimination of ‘Stretch IRA’ provisions on inherited IRAs. Prior law allowed spouses to rollover an IRA to their own. That has not changed. Most non-spouse beneficiaries such as your children, however, can no longer stretch RMDs over their life expectancy. Rather, the entire account balance must be withdrawn and income taxes paid within a 10-year period, starting the year after the death of the IRA owner. On a positive note, annual inherited-IRA RMDs are no longer required – just fully paid within the 10-year period. This also applied to Roth IRAs, although distributions remain tax-free.

Most Impacted

IRA owners with larger balances will be most impacted by the law change. Prior law allowed designated beneficiaries to stretch distributions from inherited IRAs over their lifetimes. The new law will require a greater amount of taxable income to land on the tax returns of your children sooner. Since our tax rates are progressive – higher rates paid on higher income levels – more will go to Uncle Same and less to your children without proper planning.

If we suppose a $1 million IRA and ignore growth, spreading the IRA distribution equally over ten years causes $100,000 of taxable income to your beneficiary. Contrast this with the old law where the annual RMD, based on the life expectancy of the beneficiary, would have likely been 60% to 80% less.

What To Do

There are things that can be done. These can be broken into pre-mortem and post-mortem planning.

First, you need to look at longer-term retirement, tax, and estate projections to evaluate how much tax risk is likely in your current plan and what opportunities exist mitigate taxes. You also need to review all IRA beneficiaries and trust language.

Second, if material tax risk exists, certain pre-mortem strategies become more valuable. Consider over-funding Roth IRAs or converting money from traditional IRAs to Roth at today’s low tax rates. Use an asset-location strategy, placing lower growth, and more tax-inefficient portfolio assets in your IRA and higher growth, tax-efficient assets in your Roth and trust accounts. Proper use of life insurance may also be a tax-efficient solution for many large IRA owners.

Post-mortem planning will also be valuable. At the death of the first spouse, the retirement plan should be updated to determine if excess IRA assets that are not needed during the surviving spouse’s lifetime could be disclaimed to your children.

For example, suppose $1 million is in the husband’s IRA, and the wife survives. It is determined that only half needs rolled over to her IRA. The other half is disclaimed to their daughter, who has up to ten years to distribute the IRA. Mom lives another ten years and passes, leaving the remaining IRA to the daughter. The daughter again has ten years to distribute and can effectively spread the IRA over as many as twenty years, reducing the tax burden.

Additionally, analysis is required to determine what is the best method to distribute the IRA over the ten-year period. For Roth IRAs, that’s easy. Simply defer until year ten and reap the tax-free growth benefits. Yet, it’s more complicated for inherited IRAs that will be taxed.

If you are charitably-inclined, pre-mortem and post-mortem strategies may be quite valuable as well.

Larger IRA owners may find the name of the Act paradoxical. For them, undoubtedly, careful and integrated retirement, tax, investment, and estate planning are required. The great news is tax rates are lower through 2025, so the time to act is now.

Click here to contact us and speak with an experience CFP Professional about your situation.