I remember watching the Simpsons when their first episode aired as a Christmas special in 1989. I watched it religiously for years, laughing primarily at and with Homer. A recent article I read triggered a memory of Homer and his investing approach.

Homer: “This year I invested in pumpkins. They’ve been going up the whole month of October and I got a feeling they’re going to peak right around January. Then bang! That’s when I’ll cash in.”

Homer’s investing thesis is flawed. While this is meant to be funny, many investors unknowingly have a similarly flawed approach.

Too Far Too Fast

After reaching lows in late March, the stock market has come roaring back. But has it come too far too fast?

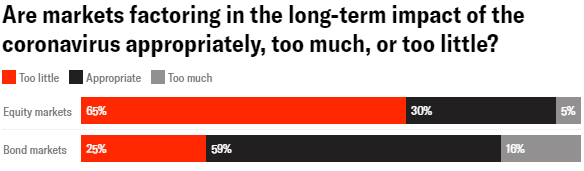

According to a survey conducted between June 18 and June 22 in Institutional Investor magazine, 65% of surveyed professionals think so, indicating the long-term impact of the coronavirus is reflected “too little” in market prices. This implies the market is overpriced, but then why has it continued to go up?

No one knows for sure, and the institutional investors that were surveyed could be wrong. But investors may be taking the Homer approach: The market is going up, so it’ll keep going up.

Investor psychology comes into play here. Several mental shortcuts our minds tend to make may serve us well in other aspects of our lives but harm us when investing. Basing investing decisions on recent performance is a common error.

A 2011 study analyzing the trading decisions of DIY investors at a national discount broker found that investment purchases had outperformed the market by 40% over two years prior to their purchase. These stocks were only identified after they had outperformed and not before. Looking forward, researchers found that if the DIY’ers would have kept the investments they sold to free up cash for their new purchase, they would have been better off.[1]

In addition to recency bias, herd mentality may also come into play. Herd mentality served us so well during tribal times where harsh conditions fostered cooperation within groups. Today herd mentality may be a contributor in bidding up stocks prices – particularly popular stocks we are familiar with and have garnered much attention during the pandemic – while lacking fundamental support.

Perhaps the modern-day equivalent of this is what the Millennials call FOMO or Fear of Missing Out. We saw FOMO during the dotcom bubble in the late 1990s, and recent reports on day-trading activity have striking similarities.

What Markets

Markets is a broad term. The question posed in the survey only asked about ‘markets’ generally and not a specifically identified market.

When you read the survey question, you likely thought of the US indices reported on the nightly news such as the Nasdaq or S&P 500. The same too for the surveyed professionals but to a lesser degree.

The S&P 500 represents about 75% of the US market and has become more concentrated into technology-based companies while other sectors, smaller companies, or other countries have less influence or are omitted. Nasdaq is almost entirely technology-based, and large technology companies have done quite well recently. Thus, the Nasdaq was up 13% through the end of June.

However, 7 of the 11 sectors in the US are negative through the first half of the year. This number rises to 9 of 11 after adjusting for companies that most think of as technology companies but are classified in different sectors – Amazon (Consumer Cyclical) and Google and Facebook (both Communication Services) – and all three are part of the Nasdaq. The only other sector that is positive is Healthcare while Energy has fallen the most down 37%.

Or if you stay within the US but migrate towards smaller companies, you find index returns are still down double digits for 2020 through the end of June. The Russell 2000 and Russell 2000 Value indexes that represent small and small value companies are down 13% and 24%, respectively.

Same too goes for stocks outside the US in both developed markets (such as Europe, Japan, Australia) with MSCI EAFE down 11% and for emerging markets (such as China, Taiwan, South Korea, India) with the MSCI EM down 10%.

What To Do

Nobel Prize winner Harry Markowitz said diversification is the only free lunch in investing.[2] I didn’t see that on a Simpson’s episode but imagine Homer would like the idea of a free lunch and diversification in the form of donuts and beer.

Perhaps some markets are overvalued while others are not. Only time will tell for certain. The wider range of economic and investment outcomes that the coronavirus presents is yet another reason to lean on prudent diversification, owning some of the more expensive assets that have gone up but a healthy dose of those with still depressed prices.

Importantly, your investments must be aligned to support your financial life plan. Just as pension funds invest with a purpose to meet monthly pension payments, you too, need to craft your investments to meet the goals you have carefully laid out in your financial life plan. Speculating like Homer or as other uniformed investors appear to be is no way to invest your life savings.

[1] https://www.barrons.com/articles/the-importance-of-diversification-51552738215

[2] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1872211