A majority of True Wealth clients own investments from Dimensional Fund Advisors (DFA) – a science-based money manager with more than $600 billion in assets under management as of March 2021. We wanted to give a brief update on some cost reductions and a structural change pertaining to some DFA funds.

DFA announced late last year plans to convert six tax-managed mutual funds into Exchange Traded Funds (ETFs). Four of these conversions took place on June 11th and you may have noticed this activity in your accounts. The conversions will be organized as a tax-free event for U.S. tax purposes. So, we anticipate no taxes related to the conversion of full shares.*

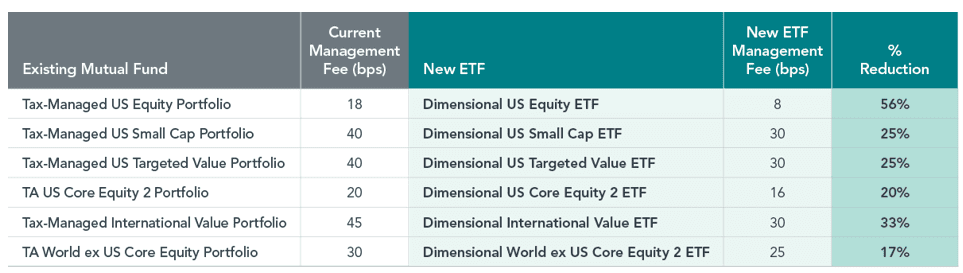

Below is a table showing the funds by current name, the name of the corresponding ETF, and annual fees charged by DFA. In each case, this conversion will result in a reduction of expense ratios. Following the conversion, DFA’s management fees of the six funds are expected to be reduced by 27%, on average, from current levels on an asset-weighted basis.

The new ETFs will be managed using the same investment philosophy and process as the outgoing mutual funds. A recent regulatory change related to ETFs has made ETFs preferable to execute DFA’s investment strategies while availing us, the investors, of the lower expense ratios and increased tax efficiency. Thus the reason for the conversion.**

If you have any questions about the conversion, please reach out to your primary advisor. If you’re not a client and want to learn more, can do so here.

Kevin Kroskey, CFP®, MBA | Managing Partner

*There may be some cases where fractional shares are held in the mutual fund and at the current time, ETF shares are not issued in fractional shares. In this case, fractional mutual fund shares will be redeemed and paid out which may result in a very small taxable event. For example, if a fractional share of $25 was held and redeemed, the relevant tax rate would be applied to the capital gain portion of this single fractional share resulting in total taxes paid of less than $25.

** Unlike with index mutual funds, an index-based ETF manager works with so-called authorized participants to create and redeem shares. These APs are usually a large brokerage, institution or other market maker who is given details about securities held by an ETF. When new shares are needed — either to launch an ETF or simply to meet demand — the AP will buy the stocks and bonds making up that ETF’s portfolio. Then, these “baskets” are exchanged to the ETF company for “creation units,” or a specified number of new ETF shares.

In general, such “baskets” turned over by APs are designed to reflect an index ETF’s overall make-up. For example, if an ETF composed of the 500 largest U.S. companies needs to create new units, the AP might collect those same 500 stocks and do an in-kind exchange for a certain amount of creation units.

A recent regulatory changes allowing a bit more flexibility as APs can now accept what are referred to as “customized baskets.” In these cases, APs don’t necessarily have to mirror the fund’s underlying holdings in exact numbers and composition. Cash can also be used in some creation/redemption instances. Such flexibility is aimed at keeping execution costs low, according to Dimensional, but won’t be allowed to sacrifice accuracy in terms of reflecting an ETF’s portfolio. Similarly, the AP can redeem creation units in exchange for a basket of securities and cash.

ETF’s unique in-kind creation/redemption process as an additional way to rebalance a basket of securities. By contrast, mutual fund shares are issued or redeemed directly through the fund company itself. When large inflows or outflows take place, mutual fund managers must issue new shares or sell securities in their funds to directly meet such demand.

Source: DFA, LLC. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing.