While traditional, defined-benefit pension plans are going away, many baby-boomer pensioners are still confronted with the complex decision of how best to take their pension. Some plans may even offer the choice of a lump sum in lieu of a monthly payment.

Why are defined-benefit plans going away? According to testimony from Steven A. Keating provided to a Department of Labor hearing, “The goal is to eliminate or to reduce balance sheet risk, longevity risk, investment risk, interest rate risk, and/or other risks borne by a plan sponsor (company).” The term used by pension consultants is “derisking,” which clearly spells out to pensioners that, if a lump sum is elected, they are incurring these risks shed by the company.

So how do you analyze whether the lump sum makes financial sense? Suppose that John is married to Jane and John is offered a pension of $30K per year. Both are sixty years old. This amount is the joint and 100% survivor benefit, so the $30K will be paid as long as either lives.

John is offered the choice of $500K lump sum today in lieu of the $30K paid in monthly installments of $2.5K for life. This lump sum could be rolled over pre-tax to a traditional IRA and invested.

First step is to see if the monthly amount is greater through the pension plan or through an immediate annuity, which offers the same payment stream as the monthly pension, with an insurance company. Running a comparison quote at immediateannuties.com (run on 9/16/2014), we see that $500K would at best provide them $2,175 per month, which is less than the $2,500. Therefore, the pension wins on this front. In my experience, this is usually but not always the case.

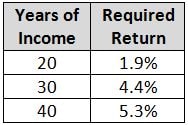

The second step is to determine the return required to produce the same $2.5K per month payment stream from investing the $500K. The table below shows this over periods of 20 to 40 years or from age 80 to 100 for John and Jane. As you can see the longer John and Jane live the higher the required return.

to 40 years or from age 80 to 100 for John and Jane. As you can see the longer John and Jane live the higher the required return.

Upon first glance, these rates of return seem reasonable to obtain from a moderate-risk, well diversified, low-cost portfolio over time. Yet they do not tell the whole story. The rates of return in the table and done with most financial calculators assume the returns are achieved each year without variation. In reality, returns will vary. This variability will lower the actual compounded return compared to the average return.

Think of it this way: would you prefer portfolio “A” with 20% year one return and -10% year two return or portfolio “B” with a 5% return in both years? Each portfolio has an average 5% return. Yet portfolio “A” grows by a cumulative 10% after two years while portfolio “B” grows by 8%. Factoring in regular distributions may further increase the return disparity.

In addition to the risks assumed by taking the lump sum, there are a slew of other considerations as well. These include the pension plan’s credit risk, life expectancy, legacy goals, tax planning opportunities, and integration of Social Security claiming strategies just to start.

Every pension plan and the actuarial assumptions within it vary company to company. Even within the same company, it is possible to arrive at different financial recommendations, as the age between spouses and associated reduction in the pension to provide a survivor benefit also matter. Each person and analysis is truly unique.

While a lump sum can often make sense, anyone facing this irrevocable decision would be wise to consult a Certified Financial Planner to evaluate it in the context of his or her financial plan before deciding.

Kevin Kroskey, CFP®, MBA is President of True Wealth Design, an independent investment advisory and financial planning firm that assists individuals and businesses with their overall wealth management, including retirement planning, tax planning and investment management needs.