How long are you going to live? None of us knows, of course, but you are likely underestimating your life expectancy.

Life expectancy is important for a variety of financing planning issues—including, of course, how long your money will have to last in retirement. Actuarial tables tell us how long people will live on average, but that is not much help for planning a specific person’s life. The averages conceal a lot of variation.

Wealth Impacts Longevity

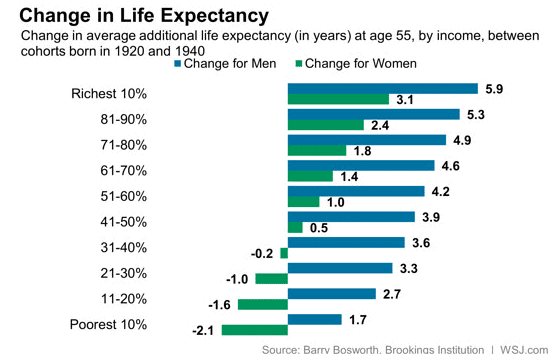

There is a significant and growing longevity gap between the top half of income earners and the bottom half. Life expectancy statistics are often quoted based on Social Security mortality tables, which represent the U.S. population in total. The median household income in the U.S. is little more than fifty thousand per year, so it does not take much to be in the top half.

To demonstrate the expanding gap, in 1912 the top earning half of workers lived about a year longer than the bottom half. Twenty-five years later for workers born in 1937 (today’s 78 year olds) the gap had widened to a 5-year difference in life expectancy.

Other mortality tables, such as the Society of Actuaries (SOA) annuity table, are more appropriate for better-than-average earners. Current SOA annuity mortality tables reflect a 43% chance that one spouse of a 65-year-old married couple will live to age 95 while it is only a 20% chance according to Social Security mortality tables. This means those who have more wealth have a materially longer life expectancy than the averages implied in the Social Security mortality tables.

Impacts of Lifestyle and Genetics

Dr. Thomas Perls is the founder and director of the New England Centenarian Study, the largest study of centenarians and their families in the world. Dr. Perls has constructed the “Living to 100 Life Expectancy Calculator.” It is accessible free at www.livingto100.com.

The site asks you a series of questions about basics such as your gender, marital status, and education level. There are questions about stress, exercise, sleep habits, nutrition, and much more, including whether or not you have a bowel movement at least every two days. At the end, you are told your calculated life expectancy and provided with ways to increase it.

When you factor in your income and the lifestyle choices that that higher-income earners typically make and are correlated with living a longer life, chances are you will be surprised at how long you are expected to live. Of course, it also means that you should take a second look at how much you have saved, what you are spending, and revisit your retirement planning projections. Spending and investing decisions look dramatically different over a twenty-year retirement versus a thirty or more year retirement.

Kevin Kroskey, CFP®, MBA is President of True Wealth Design, an independent investment advisory and financial planning firm that assists individuals and families with their overall wealth management, including retirement planning, tax planning and investment management needs.