Retirees Are Happier With Pensions

Many studies in the U.S. and other developed countries show that retirees are clearly happier having a guaranteed income stream, provided by a pension. A recent 2012 BlackRock Retirement Survey found that retirees with a guaranteed income stream are far more confident about their finances than those without. Another study found that retirees with a traditional pension are more content than those with the same level of wealth but no pension, and that retirees who have both a pension and a 401(k) are even happier.

Every pension plan is similar but also different. Some plans offer an option to cash out the pension and do a lump sum rollover to a traditional IRA. This option may be advantageous, however, electing this option generally negates the emotional benefits of having a pension and subjects the worker to the inherent uncertainty associated with investing. This uncertainty can be a significant detractor from happiness.

Other plans do not offer a lump sum option and may just offer various levels of monthly payments based on the worker’s life only (single life) and on a survivorship basis if the worker is married. The single life benefit will always be the highest benefit available and all forms of survivorship benefits will have some level of reduction from the single life amount, since the benefit will cover both lives.

Maximizing Benefits

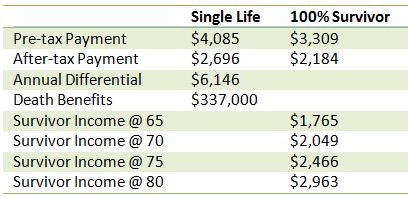

One of the best ways to maximize pension benefits is to consider the use of life insurance in conjunction with the pension.Let’s consider an example. Suppose we have a married couple John and Jane both age 64. John is planning to retire at age 65 and has a pension that will pay him $4,085 per month for his life only or $3,309 as long as either lives. This is a 19% reduction from the single life option and after federal and state taxes at a combined 34% rate, this represents an annual difference of $6,146.

One of the best ways to maximize pension benefits is to consider the use of life insurance in conjunction with the pension.Let’s consider an example. Suppose we have a married couple John and Jane both age 64. John is planning to retire at age 65 and has a pension that will pay him $4,085 per month for his life only or $3,309 as long as either lives. This is a 19% reduction from the single life option and after federal and state taxes at a combined 34% rate, this represents an annual difference of $6,146.

If John can qualify for life insurance, he can use the $6,146 to buy a fully-guaranteed life insurance policy that will pay $337,000 in death benefits to his spouse. To keep the comparison apples-to-apples, upon John’s passing, the death benefits are assumed to be used to purchase an immediate annuity that will pay a guaranteed benefit for the rest of Jane’s life only just as John’s pension would provide, if Jane survives him. Note that on an after-tax basis, John and Jane have the same income in either scenario and both scenarios are also fully guaranteed. The only caveat is that interest rates are a key variable in determining how much annuity income will be paid. However, with rates being so low today, it is very unlikely they would go much lower and lessen the annuity income.

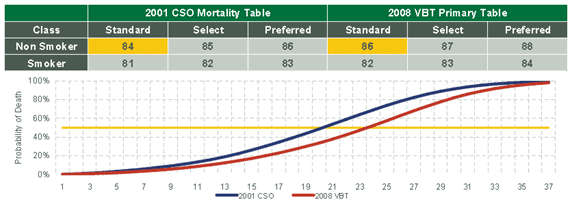

Which scenario is best is predominantly a function of how John will live. As seen from the life expectancy table, a male age 64 with a standard health rating, would be expected to live to age 84 or 86, depending on the mortality table being used. To provide an equivalent after-tax income to Jane, John would need to live to at least age 71 or seven years. From the table, we see that a male age 64 with a standard health rating has better than a 90% chance of living seven years. These are quite good odds.

Analysis must always be done on a worst-case scenario where John passes immediately after electing the single life pension. Jane must have sufficient resources from savings, investments, and other sources of retirement income like Social Security to ensure her long-term financial health.

Analysis must always be done on a worst-case scenario where John passes immediately after electing the single life pension. Jane must have sufficient resources from savings, investments, and other sources of retirement income like Social Security to ensure her long-term financial health.

On the other hand, if John were to survive Jane, he has the option of discontinuing the insurance and increasing his annual income, or the insurance can be continued and used for estate planning purposes. This brings an important point. The traditional pension will cease providing benefits after John and Jane have passed. However, the pension plus insurance option can provide a lifetime of income but also provide life insurance proceeds to their beneficiaries.

Pension elections are usually irrevocable and due care and expertise in analyzing pension planning decisions is required. From this author’s experience, whenever a 15% or greater reduction exists between a single life and 100% survivor pension, the use of life insurance may maximize benefits. The insurance must be properly designed. Further, it is generally better to look at this strategy well in advance of retirement as insurance costs increase with age and insurability may decrease.

Kevin Kroskey, CFP®, MBA is President of True Wealth Design, an independent investment advisory and financial planning firm that assists individuals and businesses with their overall wealth management, including retirement planning, tax planning and investment management needs.