Listen Now:

The Smart Take:

Shocks like the Coronavirus (COVID-19) or Russia’s assault on oil prices can’t be predicted. Yet, your financial life plan must be able to weather shocks and your investment strategy respond appropriately.

Investors are not only concerned about their health but are questioning what to do about their money. Listen to Kevin describe the current situation and prudent, processed-based response to help you tune out the noise and stay on track.

Prefer to read? See the transcript below.

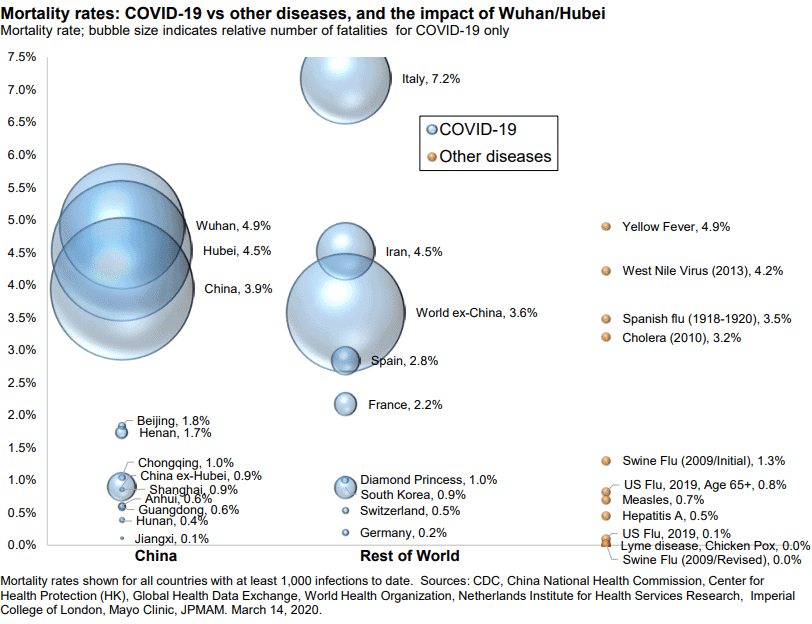

Technical Note: In the podcast Kevin described the H1N1 (Swine Flu) pandemic in 2009-10 that affected 60 million Americans. The initial mortality rate was believed to be 1.3% — more than 10x greater than the seasonal flue — but later revised to near 0%.

Need help? Want more information?

We will be hosting an upcoming webinar, discussing and illustrating appropriate investment and financial planning responses to the market turmoil. Dates will be announced shortly and communicated through our email list, which you sign up for on this page (below on a mobile device or up and to the right on your desktop).

Want to talk now? Click here to schedule a free 15-minute call to see how we can help.

Subscribe:

Click the below links to subscribe to the podcast with your favorite service. If you don’t see your podcast listed with your favorite service then let us know and we’ll add it!

Transcript:

Kevin Kroskey Prelude:

Yes, things are bad, but the economy was really strong going into this. We’re going to get through this just like we’ve gotten through way worse in the past.

Intro:

Welcome to Retire Smarter with Kevin Kroskey. Find answers to your toughest questions and get educated about the financial world. It’s time to retire smarter.

Walter Storholt:

Hey, there and welcome to another edition of Retire Smarter. Walter Storholt alongside Kevin Kroskey. He is the president and wealth advisor of True Wealth Design, serving youth throughout Northeast Ohio with offices in Akron and Canfield as well. Find us online by going to truewealthdesign.com. Kevin, I bet you haven’t had anything going on at the office for the last couple of weeks. You’ve just been probably twiddling your thumbs.

Kevin Kroskey:

Walter, it’s like I’ve been out at the beach. I’ve just been putting on the SPF 30 on my bald head and just enjoying the day away. Actually, my daughter is on spring break this week, and I was planning on taking some time off, but we’re recording this on Tuesday, March 10th. The day after, we just had the biggest point decline ever, and the points don’t matter. It was quite a large percent decline. It’s been all hands on deck over the last couple of weeks at the office, and here I am today. That’s what we’re going to talk about.

Walter Storholt:

I will say people recently have clinged to that, ooh, large point decline and using to sort of bash things recently. Well, when we’re this high up the mountain, even smaller swings are going to seem very large from a points perspective, but the swings we’ve seen lately due to the coronavirus scares in oil and some of the other things that have been in the news all surrounding the obvious elephant in the room, the coronavirus impacting the markets like it has, the percentages have started to become large, not just the points as well. That has a lot of people reacting in fearful ways, Kevin, panicked ways, confusing ways.

Walter Storholt:

It’s led to a lot of interesting discussions I’m sure that you’ve had with clients and with folks who maybe haven’t even put together a financial plan before reaching out with wondering what we should do? Should we get out of the stock market? In fact, that was something I can share a personal story real quick. My dad did that. He’s approaching retirement, my mom and dad, and they have dragged their feet. I’m going to throw them under the bus a little bit on putting their retirement plan together, and I think this is the thing that’s going to spark them to finally get a plan in place, Kevin.

Walter Storholt:

But he called me and said, “Hey, what should I do?” And I said, “Hey, I only play a financial advisor on a podcast with Kevin, so he’ll be the real one to talk to.” But in all seriousness, it was just a good thing to spark the conversation, but I could hear the panic and the uncertainty in his voice, and a lot of people are going through that right now.

Kevin Kroskey:

Yeah, absolutely. It’s really all the above. The decline that we had on Monday was certainly reminiscent of what we had in 2008 and 2009. It was certainly surprising. Just to go back a little bit, the coronavirus was happening. Frankly, I was quite surprised that it didn’t have a quicker ramification in US markets. It was affecting China, and it was spreading over there. We’ve talked about even in past podcast episodes how the US has been not only done quite well and from a returns perspective but because it’s done quite well, it’s gotten more expensive and by many different metrics. Frankly, for many years it’s been expensive. Then last year, we had nearly 30, or actually a little bit more than 30% returns.

Kevin Kroskey:

You can actually decompose those returns and say, “Well, where did the returns come from?” You look at it, and it was about a 2% dividend yield, and the vast majority of the rest of it wasn’t from earnings growth, which over time is really where stock returns come from, its earnings per share growth. But earnings per share was about flat last year for the US market. We had a 2% dividend yield. We had about flat earnings per share. Walter, we’re going to start off with some math here, buddy. I hope you came ready today. But if we had a 30% return and we got a 2% dividend yield, what’s the difference, and where did it come from?

Walter Storholt:

2% of 30% is what we’re going for?

Kevin Kroskey:

Think about it. In any sort of return, you have a total return. Total return is going to be your income return. In the case of stocks, it’s a dividend. In the case of bonds, it’s interest payments, and then you have your capital appreciation. In this case, if you have a 30% return, 2% is from income, the other 28% is from capital appreciation. Don’t worry, Walter. I’ll give you some more here as we go throughout today.

Walter Storholt:

30 minus two. Okay. You are really tripping me up there. I was ready for multiplication and division and all sorts of stuff.

Kevin Kroskey:

I enjoined it with, and tell me why, why, or how. I can’t recall exactly what I said. But if earnings growth was flat, you would expect like, “Well, hey, how did we get 28% capital appreciation and earnings growth was flat, and that really drives stock returns over time, well, where did the 28% come from?” Where it came from is people just bid up prices. The analogy that I’ve been using with people recently is suppose you bought a house in say early 2019. It’s in a nice neighborhood. There’s a lot of other houses that are similar to it. You and your spouse move in, you’re happy, all good. Then later in the year somebody comes in, buys a house right across the street, similar lot, exact same model.

Kevin Kroskey:

Maybe the paint is a little different color, maybe the landscaping is a little bit different, but for all intent and purposes, it’s virtually identical. They end up paying 30% more for the house than what you paid just earlier in the year. They still got a nice house, they still are in a nice neighborhood, but they overpaid for the house. Really that’s what you can liken to what happened in the market, and particularly the US market, in 2019. Again, people just bid up stock prices. There’s a lot of momentum. Prices went up, even though the earnings growth was actually flat for the year and had started off the year fairly strong, but then it was actually declining over the course of the year. I was certainly happy to see the prices go up. However, I was also very skeptical and very cautious.

Kevin Kroskey:

When the coronavirus came rolling around early 2020, it’s usually something like that that it sets off a decline like we’ve had recently. Now, I think the decline we’ve had recently, well, it’s a normal part of investing. The speed of it and just the consistent down days has certainly been somewhat unique, but nonetheless, the coronavirus happened, and it was on the news. I mean, I remember seeing it in China. I remember seeing it shutdown. I was quite surprised that the US seemed somewhat resilient. That quickly changed here though as we got into February and exasperated even further as we’ve gotten into March. To set the stage and I think that’s one of the reasons why the prices have come down as much as they have because they had been bid up so much before.

Kevin Kroskey:

They were expensive. Certainly, they have been correcting quite quickly, but stocks tend to overshoot both on the upside, perhaps as they did in 2019, as well as on the downside, certainly like they did in 2009 before the rebound happen. The market’s comprised of people. People are inherently emotional. The rear part of our brain, our reptilian brain, the amygdala can’t tell the difference from a bear market and a bear in the woods. It says both are bad. They go out, and they sell stocks, and they do other things that aren’t necessarily good for their long-term financial health. That’s what’s been going on. On the other hand, there seems to be a lot of just algorithmic programs, computer program type trading that’s going on. A lot of that is, I think, being worked out right now.

Kevin Kroskey:

But all that being aside, long-term as investors, we’re going to get the returns from these companies on an earnings per share basis. We’re going to get a dividend yield. That’s our total return. However, as we’re living through right now, there is a lot of noise that can be present in short-term market movements, and that’s certainly been the case recently. Now, if I transition here for a little bit, we have had a lot of people actually be referred to us recently. We’ve had a lot of people reach out. It’s usually something like this, some sort of market move like this that causes people to finally… Similar to your parents, Walter, just get that kick in the rear and say, “Okay, I can’t procrastinate anymore. Things have been going great, but hey, did I really know what I was doing?

Kevin Kroskey:

I picked some things in my 401(k), and everything seemed to be going up. The rising tide lifts all boats, but now I don’t know what the heck I’m doing. It’s time to get serious.” We’ve had a lot of those people reaching out to us recently. We’re busy, but we have the capacity. We have four certified financial planners on staff, and we’re certainly happy to go ahead and talk with you and see if we can help and make sure that we can get things in order and not make any sort of rash decision. The other thing I will say, and I think this is a testament to our clients and frankly probably to our process and our people, but whenever you have a plan in place, and you have the clarity and the confidence of saying, “Hey, yeah, the market is going crazy.

Kevin Kroskey:

I certainly don’t like seeing the red when I turn on the TV screen at night and all these media reports. Man, they just keep using these four-letter words in some way, but it all comes back to fear because fear sells in the media. But I can log into my client vault. I can see that, hey, even though the market’s down whatever percent today, I can see that my financial plan results, we’re still on track. I’m not going to have to go ahead and change my lifestyle. Yes, the short-term gyrations are somewhat unsettling, but I can go ahead and tune out the noise. I can focus on what matters, and the short-term gyrations are not going to impair my long-term financial health. It’s not even close to it.”

Kevin Kroskey:

We’ve been really encouraging our clients just to go ahead and log in to their portals, log into their client vaults in and take a look at that. Their financial plan results are updated every single day. They can see their success meter and their safety margins and just make sure that they’re still on track. Basically, it’s a simple a red-green type thing. If you’re in the green zone, you’re good. Our software makers are maybe a little bit PC. They didn’t want to make it red. It’s more of a magenta. If you’re down that way, then it’s giving us some feedback that hey, maybe we do need to go ahead and reign in spending a little bit.

Kevin Kroskey:

We’ve talked a lot about spending goals in different podcast episodes over the last year and a half that we’ve been doing this. But this is the point in time where if your plan isn’t really well-funded, that some of the more discretionary goals you may need to start considering, hey, do I really want to go ahead and spend those dollars? Well, the good news is if you’re planning on spending the money on a cruise, you don’t have to worry about it. The decisions made for you. Right, Walter?

Walter Storholt:

Oh, man. I know a few people who are still planning to go on a cruise in early April, and I’m scratching my head. I don’t know how anybody could pull that trigger right now.

Kevin Kroskey:

Yeah, nor do I. One of our neighbors just took… Husband and wife and four kids on a cruise now because it’s spring break where we’re at. Yeah, I don’t think I would do that. But anyway, having that predetermined financial plan, having the goals accurately reflecting your lifestyle and ranked and prioritized based on your needs, your wants, and there’s more discretionary wishes, that’s the framework that we operate in. I think it takes a while for clients to really get used to the program. But after they see this, after they hear us explain it and repetition certainly doesn’t hurt over the years, but we stress test for way worse environments than we’re going through right now. We have a game plan in place.

Kevin Kroskey:

The key is, and this is again, one of the reasons why I’m not on vacation this week, is now is the time to execute the plan. The financial plan is already in place. There are some different things that we need to do from an investment standpoint, but the key is you really can’t go ahead and just panic out. I mean, if you do that, people have heard this. Certainly, people feel like, hey, if I go ahead and sell and go to cash… Walter, did you say that your dad actually did that?

Walter Storholt:

No, he did not. I advised him against that. I said, “Don’t panic. Now is not the time you’re.” He’s just turning 60 this year, so he still has a few more years before he’s going to pull the retirement trigger. I said, “This is not a reason to panic and sell everything right now.” I said, “I think I can provide you enough guidance to at least say that. I can be your voice of calmness right now.”

Kevin Kroskey:

Yeah, no. Well, that’s great and kudos to you for helping him and for him actually listening. It’s just something for people that particularly I think that don’t have a plan. They can’t see how their money is going to be connected to their financial well-being and go through a process similar to what we just preached basically on the podcast about connecting your life to your money and showing how the investments are going to support all the things that you are and that you want to do. Anything that’s not going to be met by your social security, your pension, your investments obviously do, and have to be tailored back to your financial plan, back to your lifestyle to go ahead and support that.

Walter Storholt:

Yeah. One of the things I told him too was you’ve never been one to play the market or anything like that, and you don’t have that desire anyway. Even if these funds were for the fun money, let’s say, then sure, maybe you could say, “All right. Well, let’s see if this thing goes down further. Let’s cash out. Wait a little while.” I said I wouldn’t even recommend that if it was your fun money just based on a lot of the guidance that I’ve gotten from Kevin over the many months we’ve done this show and the many episodes that we’ve had here by osmosis and by active listening have been able to absorb from some of your great advice. He needs this money for retirement. I said, “You don’t want to go gambling with that and sell everything today because, dad, what happens if…”

Walter Storholt:

This, I think, was on that first Friday of the first week where we’d really had the downside. I said, “What happens on Monday if a thing’s rebound and they go up? The 10% that you sell at the bottom today, what if they go up back on Monday after you’ve gone to cash, and you can’t get that 10% back?” I said, “You’ll be kicking yourself forever.” I said, “Yeah, it’s probably going to go down some more, but you’ve got the time to absorb this hit and this frustration. It just takes some patients, but let this be that bellwether, let this be that thing that gets the plan in place for the future.”

Kevin Kroskey:

Yeah. I think something that’s really important for everybody to keep in mind. I’ll phrase it into somebody that’s my age, mid-forties and still working, and then somebody who’s retired. For myself, my wife has a consulting business. She was a writer and editor, and she does some of that work still. We are making her 401(k) contribution this week what’s in process right now. I’m not going to be able to pick the bottom. Nobody is. We’ll talk about the timing aspect actually a little bit more in the next episode and why you can’t time it, but we’re going to make that contribution now.

Kevin Kroskey:

It could certainly get a lot worse. However, I feel quite confident that when I look back in a couple of years that I’m going to be happy that I put it in at this point in time because the money will have grown. With investing, there are no guarantees, but I mean, historically, that’s how markets work. Capitalism makes the pie bigger for people. We invested in these companies, and they go ahead and produce earnings. We get that through owning the stock or owning mutual fund shares, what have you, and stocks are certainly a lot cheaper than they were just a few weeks ago, and not only in the US. US sold off a lot more recently, but we’re going to be globally diversified. We own Chinese companies. We own companies in India, companies in Europe. You name it.

Kevin Kroskey:

Some of those countries actually have held up better than the US even though so far they’ve been more disproportionally effected. In part, I would speculate because their valuations or their prices weren’t nearly as appreciated and high as the US. The US, said in another way, had farther to fall because the prices had climbed up so much. These are all I think important things to keep in mind. A couple of things that frankly you don’t hear, I mentioned this in passing, but whenever you turn into media, all you hear is all the negativity, all the fear. I mean, I was just having lunch, and the TV was on, and it was CNBC.

Kevin Kroskey:

By and large, I don’t recommend that people watch CNBC, but there have actually been some good guests on recently, so I’ve been tuning in and staying abreast of things. But all that they were doing was flashing back to yesterday about, oh, the biggest one day drop ever. Well, I mean, I don’t want to jinx it, but the last I looked, the market was up about 2%. It’s certainly a far cry from how much it had fallen yesterday. All that they’re doing is going flashing back to all the bad news from yesterday. They’re not talking about the good stuff today, or the other thing that I noticed a lot is when they’re talking about the coronavirus, and they’re saying, “Oh, more than a hundred thousand people infected.”

Kevin Kroskey:

Yesterday I was looking at this interactive map that Johns Hopkins is doing, and there’s more than 113,000, but the vast majority of those people not only have recovered, but those aren’t active cases. Last I checked and granted testing is certainly behind schedule it seems to be here domestically, I’m not exactly sure about other parts of the world. However, the number of active cases for several days has been declining, and you didn’t hear any of that. All you heard was about the total confirmed cases. All you heard about were the deaths. Walter, I know you’re a younger millennial here, but do you recall the swine flu?

Walter Storholt:

I do remember it. I don’t remember it getting as much attention, though.

Kevin Kroskey:

I don’t either.

Walter Storholt:

I remember the Ebola scare getting much more attention even though that had a much smaller spread.

Kevin Kroskey:

Yeah. For us, my wife and I we were pregnant or trying to get pregnant, so Zika was really big for us because-

Walter Storholt:

That’s right. I remember Zika very well. Yeah.

Kevin Kroskey:

Yeah, because babies were disproportionately affected, and mothers were at risk. There’s some of that, but swine flu 2009-2010, it affected more than 60 million people in the US. 60 million. How many cases of coronavirus are identified in the US right now?

Walter Storholt:

So far, still at a few hundred at the moment.

Kevin Kroskey:

Yeah. It’s like less than a thousand. Again, the testing isn’t there. I get it, but I don’t care if everybody was tested.

Walter Storholt:

We’re not off by 60 million.

Kevin Kroskey:

No, it’s one in five people who had the swine flu. The mortality rate, I think it was like two or three times the regular flu, but I mean, it was everywhere. Maybe and granted 2009-2010, we were still coming out of the global financial crisis, the market bottom in March of 2009, social media platforms I certainly don’t think were as widely used back then. Maybe that’s exacerbated some things. But I mean, it was way worse. Walter, I don’t know about you, but after the swine flu and one in five Americans and more than 60 million Americans were affected. Do you remember the market going to zero?

Walter Storholt:

Mm-hmm (negative). Not at all.

Kevin Kroskey:

Yeah, I don’t know either.

Walter Storholt:

I mean, maybe because we were already near the bottom, it just didn’t have anywhere else to go it felt like.

Kevin Kroskey:

Yeah. I think that it could be… I mean, we had been rebounding, returns ended up being quite strong in ’09 and ’10, but there was this lag and this perpetuating fear about having the second shoe to drop or a double-dip recession was the nomenclature back then, but prices were quite cheap, and again, where we started the conversation earlier today was the prices were quite high. Certainly, the markets are always different, but the market always behaves in a similar way. They’re a discounting machine, and anytime there’s risk or uncertainty, then that’s going to be factored into the price.

Kevin Kroskey:

When the price is lower, to begin with, and you have a margin of safety when you’re buying it, well, when you go through that discounting process, it seems reasonable to go ahead and hold that. It’s not going to fall as much. But nonetheless, I mean, I think we just got to put this in perspective. I’m not trying to be Pollyanna or glad in the situation. It’s certainly serious. It’s obviously more serious for certain age groups; it seems from the mortality perspective. We all need to be smart. Certainly, it has economic ramifications. Events are being canceled. Transportation is really being hampered, particularly for airlines.

Kevin Kroskey:

As you intimated earlier, you had Putin surprisingly doing something crazy over the weekend or maybe genius, I’m not sure from their perspective, but causing these shockwaves in the global energy markets. However, again, let’s put this in perspective, guys, and gals. The US economy… The economy and the markets are two different things. Again, I mean, I think I exemplify that pretty well. Going back to 2019, the earnings growth was slowing down. The economy was doing pretty good, but prices were doing exceptionally well and just a little bit exuberant if you will. Now going into 2020, we had unemployment claims continually trending down. The unemployment rate was three and a half percent. Retail sales numbers were really strong in January and February and up over the prior year.

Kevin Kroskey:

The Atlanta Fed was projecting like a 3%-3.1% real GDP growth for the first quarter. Yes, things are bad, but the economy was really strong going into this, and certain things are going to happen where there’s going to be pent up demand. Whenever we come out of this, those things are going to start happening and going to happen quickly. Sometimes you’ll hear like a V or a U shaped recovery. You don’t know what shape it’s going to be. You don’t know what the amplitude or acceleration that there’s going to be, but you’re going to see a global coordinated, potentially fiscal, certainly monetary stimulus package that’s going to put a lot of gas in the tank for the global economy. We’re going to get through this just like we’ve gotten through way worse in the past.

Kevin Kroskey:

When we do that if he sold… Again, kudos you, Walter, for not letting mom and dad do that, but you’re going to look back on that and say, “Wow, maybe I got lucky and sure I’ll take luck any day of the week.” However, Walter, as far as I know, when people go to Vegas, and they play games, there’s a saying that comes to mind like the house always wins, right?

Walter Storholt:

Right.

Kevin Kroskey:

You’ve heard that before?

Walter Storholt:

Nobody walks away from Vegas with more money than they went there with typically.

Kevin Kroskey:

Yeah, or what I love about it is when they come back, it’s like they have this selective memory and they only tell you about their winners, but they negate the losers.

Walter Storholt:

That’s right. You don’t talk about the net when you come back from Vegas. You talk about the one good hand you had.

Kevin Kroskey:

Right. Some people are going to go ahead and sell, and they’re going to sit out, and maybe then they’re going to get back in time and get lucky. Kudos to them if they do, but we’ll go into detail in the next episode why this doesn’t work. But for most people, and I can tell you, we still have clients that I met just in the last couple of years that panicked in 2008 and literally nearly took them a decade just to get out of the stable value fund and their 401(k) and back into the stock market and all the while just miss a ton of wealth creation over those years. It just doesn’t work, guys. It just doesn’t work. You have to go ahead, and you have to be disciplined. It’s not all bad news that’s out there. Stock prices have gotten lower.

Kevin Kroskey:

You’re going to go ahead, and if you’re doing this right, you’re selling the bonds that have done really well. Interest rates have gotten appreciably lower. You’re buying the things that are causing pain and went down in value. The basic rule of investing is a disciplined process called rebalancing, and it’s forcing you to buy low and sell high. Everybody wants to do that. Everybody wants to buy low and sell high, but in times like these, it’s difficult, and that’s why you really need to be process-driven rather than some sort of reaction. These are just some things that I’m hoping will help some people that are tuning in. Just keep things in perspective.

Kevin Kroskey:

There’s a lot of gloom and doom that’s out there, but again, that’s how media sells more spots or gets more clicks or whatever these days, but it’s not all bad. Certainly, it’s going to get worse. It’s going to spread. There’s going to be more confirmed cases or more active cases that are identified in the US undoubtedly so. People are responding. You see schools already doing distance learning. There are these events, South by Southwest and other sorts of sports and entertainment events that are being canceled. Unfortunately, that sort of revenue is lost. There is no pent up demand there really, but we’re going to work this through. Interest rates are lower. Consumers are going to be refinancing. Oil prices are a lot lower. Gasoline is going to be cheaper.

Kevin Kroskey:

That’s going to be a big stimulus. The government’s likely to do something from a fiscal perspective with congress and the president, as is the fed, as are other countries and economies. It’s going to be okay. It’s going to get better. If you’re younger and you’re investing, more likely than not, this is buying opportunity. If you’re retired, and this is something I didn’t mention earlier, I set it up, and I failed to follow through with it, so I’ll close the loop now, Walter, but for those that are in retirement, none of our clients are living on stock money over the next couple of years.

Kevin Kroskey:

When you think about your portfolio, if you just do a simple time segmentation and you look and say, “Well, hey, say I got a million bucks, and maybe I need $500,000 to live over the decade from 60 to 70.” I’m just making this up as we go and using round numbers. But if you have 50% in bonds and 50% in stocks, you can theoretically just spend down all the bonds and receive all the interest payments on the bonds and not have to sell stocks for an entire decade. We had 2008. Stock prices peaked in late 2007, went all the way down, and bought them in early 2009, on March 9th, 2009, and it took about three years ago from the very tippy-top in 2007 all the way down and back again. If you go back through history, that’s about the longest period that there’s been.

Kevin Kroskey:

There are two of those big dips in the Great Depression, but we’re talking about a three year period. Even if you’re in retirement and you’re going to have a diversified portfolio, some stocks, some bonds, just think of the stocks as the longer-term dollars. Those are the dollars that need to grow, but more to go ahead and provide the inflation protection you need and provide the money for 10 or 20, maybe even 30 years down the road. Think about the bonds in your portfolio, and they should generally be more conservative bonds that you’re living off of as the dollars that you’re going to need for tomorrow, for the next year and the year after that. If you think about it that way, and we did this in 2008, most of our clients have about five years’ worth of bonds or more that they can live off of.

Kevin Kroskey:

Some just because their plans are really, really well-funded, frankly, they have upwards of 20 years of bonds, and the stocks can be thought of as 20 plus year money. That’s been one of the things that I found in practice really helped people. We have these financial plans, we have this green zone, but when you break it down like that and just say, Look, here’s your allocation, here’s your investments, here’s your income for tomorrow. Yes, you have some cash at the bank. But from the portfolio, you have a certain amount of dollars in bonds you’re spending say, again, 50,000 a year. You got 500,000 in bonds. Ignoring the interest payments on the bonds, you got ten years of income in bonds.”

Kevin Kroskey:

When you start thinking about that way, my hope is that you can just even better ignore the daily gyrations of the market, be disciplined, rebalance, sell some of the bonds that have held their value and appreciated, buy the stocks that went on sale, buy low, sell high, stick to the plan, stick to the process. Don’t make a knee-jerk reaction.

Walter Storholt:

Stick to the plan. If you don’t have a plan in place, it’s time to get one. The other big takeaway from today’s show for sure. In the next episode, we’re going to talk some more about volatility. We’re going to find out a little bit more, Kevin, right, about how you yourself responded to tweaking and making changes to your clients’ portfolios.

Kevin Kroskey:

Yeah. I’m going to go a little bit into some of the evidence on why this market timing doesn’t work because it’s so darn seductive, and it’s so easy for unscrupulous advisors to go ahead and sell this. I was going to use a certain word that started with an S and had four letters, but I’m going to refrain from doing that, Walter, but sell that stuff to people. As you can probably tell from the intonation of my voice, it just really irks me. At the same time, even for those people that aren’t being sold as sort of market timing strategy, it feels good, I get it, to go ahead and take control of your money, but that is such a mistake. You cannot mistake activity for control. I want to dive into that first, and we’ll see how that goes.

Kevin Kroskey:

Not to drone on, but then we can get into some portfolio changes, how to respond in the current market environment, which I feel may be instructive as well.

Walter Storholt:

The five-letter S word stuff is just as applicable in this situation.

Kevin Kroskey:

Thank you.

Walter Storholt:

That’s all right. We’ll take that one. If you want to get in touch… Although we don’t have the FCC to worry about on a podcast, Kevin, so I mean…

Kevin Kroskey:

I was not aware. I was always concerned about like in iTunes getting that little explicit…

Walter Storholt:

Oh, that’s true. We might have to mark this episode as explicit if you go the full route. Yeah, we’ll keep it family-friendly, so we don’t have to add that explicit tag to the show.

Kevin Kroskey:

Sounds good.

Walter Storholt:

But your point well taken today for sure. We’ll look forward to that next episode, Kevin. In the meantime, if this is something that’s causing you worry or concern and you’d like to talk about it, it really helps, let me tell you, to talk to somebody who has been through these market ups and downs before, knows how to navigate them and can provide you with a great direction. You can speak with a member of the True Wealth Design team by going to truewealthdesign.com and click the are we right for you button to schedule a 15-minute call with an experienced advisor on the True Wealth team. Just go to truewealthdesign.com and click the are we right for you button, or you can always call 855-TWD-PLAN. That’s 855-893-7526 if you want to do it the old fashioned way.

Walter Storholt:

Well, we look forward to the next show with you, Kevin. In the meantime, thanks for being with us, and we’ll talk to you soon.

Kevin Kroskey:

Thank you, Walter.

Walter Storholt:

All right. We appreciate it. That’s Kevin Kroskey. I’m Walter Storholt. Thanks for tuning in. We’ll talk to you next time on Retire Smarter.

Outro:

Information provided is for informational purposes only and does not constitute investment tax or legal advice. Information is obtained from sources that are deemed to be reliable, but their accurateness and completeness cannot be guaranteed. All performance reference is historical and not an indication of future results. Benchmark indices are hypothetical and do not include any investment fees.