The Bipartisan Budget Act of 2018 included several changes to how Medicare is administered and paid for. These changes will affect most Medicare beneficiaries and especially high-income beneficiaries.

Donut Hole

Medicare’s prescription drug plans, called Part D plans, cover 42 million seniors. Employer-provided insurance often has a stair-step trait where the beneficiary shoulders a higher percentage at lower total costs and the insurance pays more or all as costs escalate. You can think of this as the insurance company providing catastrophic coverage.

Medicare Part D, on the other hand, has a scale steps up, down, and back up again. Under current rules, beneficiaries pay 25% (initial coverage period) to a higher percentage that ranges from 40% to 51% (called the donut hole) and then down to 5% (catastrophic coverage).

The donut hole had already been shrinking, as enacted under the Affordable Care Act, and was on track for elimination in 2020. The budget deal advanced the elimination of the donut hole by one year to 2019. Contribution rates by beneficiaries will be a straight-line 25% and 0% for those that reach catastrophic levels.

Some Medicare Advantage Prescription Drug plans and stand-alone Medicare Prescription Drug Plans provide partial or full coverage during the donut hole. Given the elimination of the donut hole and other important but less known changes, it is unclear how premiums will be affected come 2019.

While you can say there will be winners and losers from virtually any legislation affecting a large group of people, eliminating the donut hole and providing a clearer contribution rate is a step in the right direction.

Surcharges

How will the government pay for these and other benefits included in the budget act? Well, they won’t … not entirely. Estimates by the Congressional Budget Office show the budget act will increase deficits by $320 billion over 10 years.

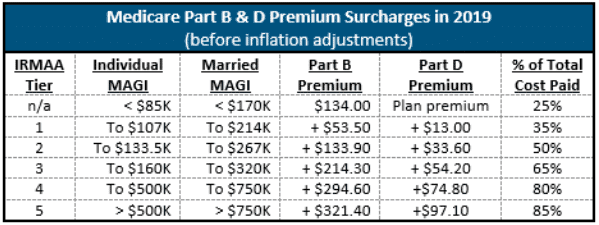

Since 2006, Medicare is paid for through means testing. The Medicare Modernization Act has required that certain “high-income” individuals pay an Income-Related Monthly Adjustment Amount (IRMAA) as a surcharge on their Medicare Part B and Part D premiums. High-income is defined by modified adjusted gross income (MAGI). In short, MAGI is your adjusted gross income on the bottom of the first page of your tax return plus any tax-exempt interest.

In 2018, the surcharge starts at an extra $53.50 per month, can rise as high as an extra $294.60 per month on Medicare Part B with similar but small dollar increases for Part D. The new budget requires individuals earning more than $500,000 a year, or joint filers earning more than $750,000, to pay 85% of the actual costs of their Part B and D plans in 2019, up from 80% this year in 2018.

It is important to note that there is a two-year look back when it comes to determining IRMAA. So, your 2017 tax return will determine premiums you pay in 2019. Thus, even if you are subject to IRMAA in one year, in another you may not be. Proper tax planning may help mitigate your costs over time.

Kevin Kroskey, CFP®, MBA is President & Sr. Wealth Advisor with True Wealth Design, an independent registered investment advisory and wealth management firm specializing in retirement, tax, and investment planning for successful familes at or near retirement.